SHI Update 3/15/17: Happy FED-Day!

March 15, 2017SHI Update 3/29/2017: French Fried?

March 29, 2017

Every human needs 3 things.

Food, shelter and clothing. Well, clothing is optional in some parts of the world.

Shelter, however, is not. From the earliest of days, mankind needed shelter from the elements. This has never changed. What has changed, however, is the fact that the demand for “shelter” is no longer a local phenomenon. Meaning a family living in Orange County, hoping to buy their first home, may be competing with other buyers from the OC and China, Taiwan, India…and the list goes on.

Diana Olick, the CNBC housing reporter, earlier today commented that housing prices are – once again – UP, affordability is DOWN, and the ‘homes-for-sale’ inventory is down sharply once again, this time by 6.4%. The supply of homes for sale is now at 3.8 months. (“Normal” is about 6 months.) This marks 21 straight months of decline and the February supply is at the the lowest level since the NAR began tracking this metric in 1999. Diana’s final comment: “A lot more people cannot find or afford a home.”

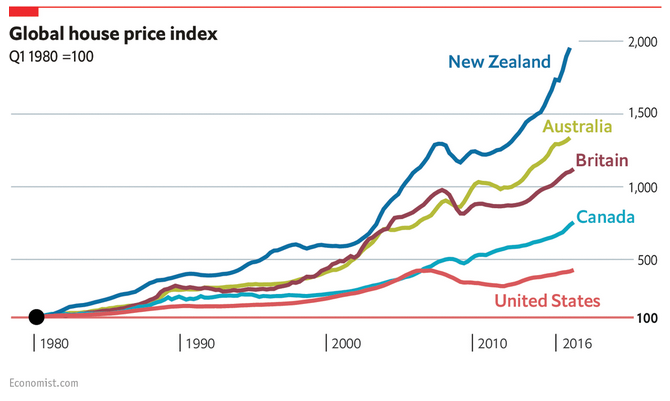

However, compared to many other countries around the globe, US housing prices are quite low. Crazy talk, you say? Well, check out this graph, courtesy of the Economist magazine:

Since 1980, US home value growth is the lowest of the 5 countries shown. What’s driving the home price increases in these markets? Foreign money competing with local buyers for the same house. Much of it from China.

Prices in Canada are way up. In Vancouver, home prices are up 39% in one year. Yes: That’s ONE year! Last year, the provincial government of British Columbia was so concerned, they enacted a 15% tax on foreign buyers of Vancouver homes. “There is evidence now that suggests that very wealthy foreign buyers have raised the price, the overall price of housing for people in British Columbia,” said Christy Clark, the province’s premier.

The result? According to the Economist, the number of foreign buyers of Vancouver property dropped by 80%. Of course, the tax had the unintended consequence of pushing up home demand – and home prices – in nearby Victoria and Seattle. 🙂

OK … clothing is optional (not in Canada), we’ve talked about price increases in ‘shelter’. How about food?

Good news! Food is cheaper! Steak prices are down!

On March 21st, the BLS reported, “Prices for meats decreased 8.1 percent from a peak in January 2015 to February 2017, with beef and veal prices declining 10.1 percent over this period….” Fantastic! So Mastros’ steak prices must have declined as well, right? 🙂

W

elcome to this week’s Steak House Index update.

As always, if you need a refresher on the SHI, or its objective and methodology, I suggest you open and read the original BLOG: https://terryliebman.wordpress.com/2016/03/02/move-over-big-mac-index-here-comes-the-steak-house-index/)

Why You Should Care: The US economy and US dollar are the bedrock of global economics. This has been true for decades…and notwithstanding plenty of predictions to the contrary, it will continue to play this role for years to come. Fear not.

Nominal global GDP is about $76 trillion. US GDP is almost $19 trillion. Is it growing or shrinking? If it’s growing … how rapidly? How might this information impact our daily financial and business decisions?

The objective of the SHI is simple: To predict the GDP direction ahead of official economic releases. While the objective is simple, the task is not. BEA publishes GDP figures the instant they’re available. Unfortunately, the data is old, old news; it’s a lagging indicator.

‘Personal consumption expenditures,’ or PCE, is the single largest component of the GDP. In fact, the majority of all US GDP increases (or declines) usually result from (increases or decreases in) consumer spending. Thus, this is clearly an important metric to track.

I intend the SHI is to be predictive, anticipating where the economy is going – not where it’s been. Thereby giving us the ability to take action early. Not when it’s too late.

Taking action: Keep up with this weekly BLOG update. If the SHI index moves appreciably – either showing massive improvement or significant declines – indicating expanding economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG: Let me start with two assertions: First, I believe Mastros’ continues to charge astronomical prices for their food. If beef prices are down, they are pocketing the difference. As they should. Welcome to American capitalism.

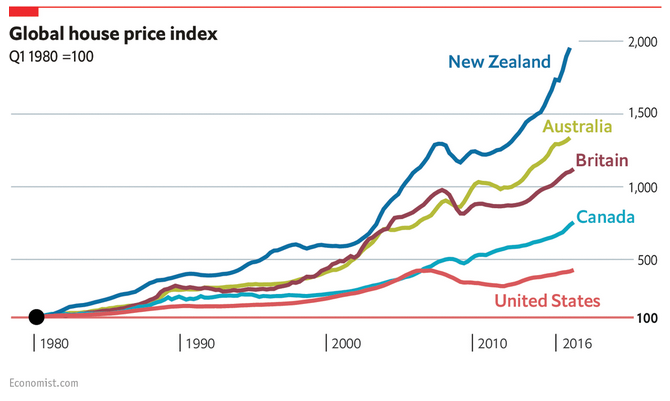

Second, like Mastros’ steak prices, US home prices are going only one direction – UP. It’s a pure supply/demand play. New supply growth (new homes) trails household growth. Demand growth, on the other hand, is significant. Rich foreign buyers, seeking growth and safety, have changed the game. The same is true around the world. Take a look at this chart, again courtesy of the Economist magazine:

Note the “% change” numbers above are “real” – meaning not nominal.

Meaning, further, the numbers above were adjusted down for inflation. Which means the 3.7% US value increase last year is actually closer to 6% than 4%. And the actual price increases in New Zealand, China and Canada are MUCH higher than the numbers show.

Per the Economist,

“In many of these countries affordability looks stretched. The Economist gauges house prices against two measures: rents and income. If, over the long run, prices rise faster than the revenue a property might generate or the household earnings that service a mortgage, they may be unsustainable. By these measures house prices in Australia, Canada and New Zealand look high. In America as a whole, housing is fairly valued, but in San Francisco and Seattle it is 20% overpriced.”

According to a National Association of Realtors (NAR) ‘Q1, 2017’ survey, 72% of people surveyed believe that now is a good time to buy a home. 47% believe that strongly, up from 45 percent in Q4 2016 and 44 percent one year ago in Q1 2016. More than 1/2 of those surveyed believe home values in their community will continue to rise. I agree.

So does Fannie Mae.

Fannie believes home prices will rise by more than 5% this year, and almost 4% in 2018:

The bottom line: If you can, buy a home. It will probably be the best investment you’ve ever made.

On the other hand, while buying a Filet Mignon at Ruths’ Chris remains fairly popular, it’s not a great investment choice. But that’s not stopping many of our local well-heeled consumers of high-dollar steaks. This week, for some odd reason, Mortons seems to be encountering difficulty booking tables, and the SHI is a bit weaker than in recent weeks:

With an SHI reading of negative (-11), at first glance consumer demand might seem a bit muted. And perhaps it is. On the other hand, comparing our current SHI reading to the same week last year, we see that the weeks of 3/16 and 3/23, showed readings of (-12) and (-5), respectively. All of which suggests consumer spending, at present, is on par with last year. Which makes sense to me:

Today’s SHI reading suggests the irrational “steak exuberance” from earlier this year may have cooled. Suggesting, if the SHI is an accurate barometer of the “consumer spending” component of the GDP, GDP growth may be cooling slightly. Just slightly. We’ll continue to watch.

But housing demand and home prices are not cooling. Go buy a house.

1 Comment

[…] Home prices continue to increase. Just as I predicted in my SHI update on March 22nd. Take a look: https://www.steakhouseindex.com/shi-update-32217-safe-houses/ […]