The FED Watches Inflation like a Hawk

The VIX goes Crazy!

September 9, 2016SHI: Steak House Index UPDATE 9/14/16

September 14, 2016Hawks and doves…which FED member is which? There is no shortage of rhetoric and histrionics in the media today. From both the reporters and FED members.

Let’s separate some fact from fiction.

Why you should care: On September 20, the FED begins its 2-day meeting to consider the state of the US economy. As the only central bank of a developed nation actually considering a rate increase, their choices, words and actions have wide-spread implications.

Taking Action: Once again, I say stay the course for now, but keep this in mind: I believe the FED will raise short rates by 1/4 of a percent – but not until November 2 (at the earliest) or December 14. Adjust your personal and business choices for this eventuality.

The BLOG: I have no doubt the FED ‘Hawks’ want a 1/4 percent rate increase. Now. They’ve told us they do.

But not for the reason they say.

The Hawks challenge, unfortunately, is that they have no ‘smoking guy’ supporting their desire to raise rates now. Sure, the employment situation has firmed. That is a fact. However, less factual is to what extent. The official unemployment rate is low at 4.9%. But my alternative measures of labor strength, the U-6 remains at a seasonally adjusted 9.7% unemployment rate. And the labor participation rate is hovering near all-time lows.

But the flip side of their dual mandate is a 2% US inflation rate objective. And no matter how many times the Hawks say this goal will be achieved soon, the facts simply don’t support the claim. Regardless of which inflation measure we use, the PCE or the CPI-U.

For example, a few days ago the BLS released this fun chart showing household spending patterns in 2015:

And they said this: “The average U.S. household spent $55,978 in 2015, a 4.6-percent increase from 2014. During the same period, the Consumer Price Index (CPI-U) was virtually unchanged, rising 0.1 percent. ”

(here’s the release if you’d like to take a closer look: www.bls.gov/opub/ted/2016/household-spending-increased-4-point-6-percent-from-2014-to-2015.htm)

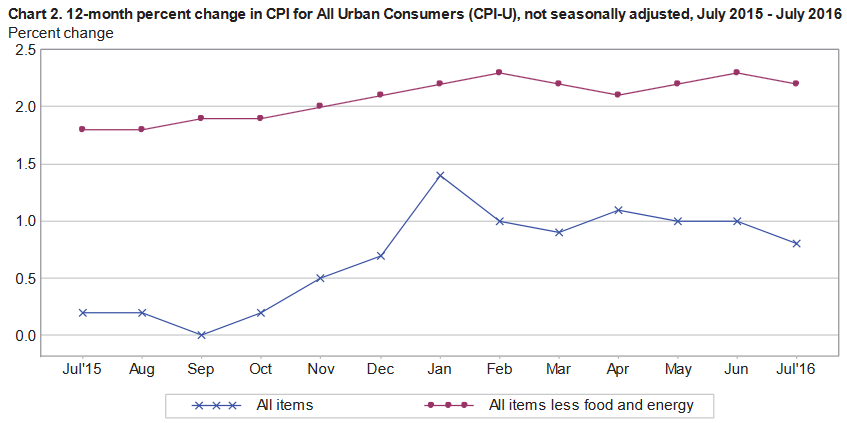

OK…about zero inflation in 2015. How about 2016? Here’s the most recent CPI-U chart from our friends at the BLS:

And here’s what they said: “The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in July on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 0.8 percent before seasonal adjustment.”

Look at the blue line above. For almost the entire year, the CPI-U has hovered near the 1.0% mark. By my measure, if the goal is a 2% inflation rate, we might be 1/2 way there. Sure, we can get closer to the FEDs 2% goal if we ignore food and energy costs. But I think those two things are pretty important, don’t you? They have both moved down in price…in a deflationary way.

The Hawks true concern is asset prices. They are concerned that 7 years of near-zero interest rates may be inadvertently inspiring bad investment choices, possibly creating asset bubbles.

But while the FED talks about these concerns, preventing bubbles is not within their mandate. Thus, all the Hawks can do is talk. Which they’re doing. A lot.

Robert Brusca has been a Wall Street economist for over 25 years. Previously, he was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), and now writes for Haver Analytics. I found his comments in a recent post to be particularly insightful and entertaining:

“Flat and too-low US inflation yet a rate hike looms?

With U.S. inflation and wages still subdued with no recent uptrends as inflation has flat-lined in recent months with the headline a full percentage point below its “target” the Fed is NONETHELESS rumored to be “on the fence” about a rate hike. Several major Wall Street houses are calling the odds of a September rate hike at 50/50. I find this absolutely astonishing.

A strange game afoot?

But then some people see ghosts. Some take pictures of UFOs. Others claim to have seen Big Foot. So who knows what other people really see. It is quite curious to me that in this global environment and with the US economy in its own particular environment of disappointment anyone could take seriously the prospect of a Fed rate hike in September. By my way of accounting- and I have been either watching the Fed from the outside or working there since 1977 – there is some strange game afoot.”

Strange indeed. The Hawks “ghostly concerns” aside, their is little true data supporting the rhetoric. We will see market volatility, but little – if any – movement by the FED in the near future.

- Terry Liebman