SHI Update 1/18/17: Steaks on Fire!

January 18, 2017How to Ruin a Country in 15 Years

January 29, 2017

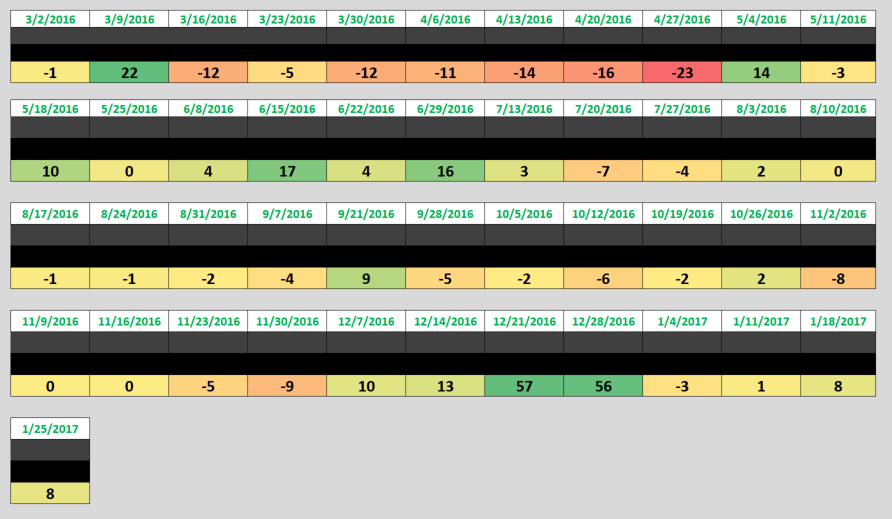

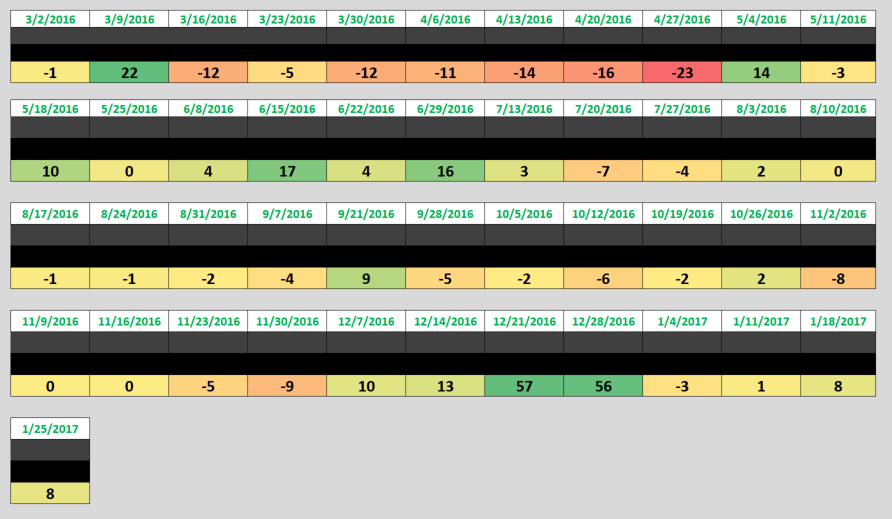

Make no mistake: Steakonomics is a tantalizing and tasty topic. But this week … well … there’s not much new to report. For the 3rd time in SHI history, our algorithm has yielded the same reading as last week: A positive 8. So, clearly, steady as she goes. But we do have a surprise or two … so don’t leave yet. Keep reading. 🙂

Have you heard? The DOW breached 20,000 for the first time! That’s exciting!

Welcome to this week’s Steak House Index (SHI) update.

Remember: The Steak House Index BLOG has its own URL – https://www.steakhouseindex.com/ The reading experience on the site is much better than in the email form. I suggest you click the link and give it a try!

Why You Should Care: The US economy and US dollar are the foundation of global economics: our nominal GDP is over $18.5 trillion a year. Is it growing or shrinking? Is it possible to know – before the quarterly GDP releases from the BEA?

The objective of the SHI is simple: To predict the direction of this behemoth ahead of official economic releases. But while the objective is simple, the task is not.

BEA publishes GDP figures the instant they’re available. Unfortunately, it is a trailing index. The data is old news; it’s a lagging indicator.

‘Personal consumption expenditures,’ or PCE, is the single largest component of the GDP. In fact, the majority of all GDP increases (or declines) usually result from (increases or decreases in) consumer spending. Thus, this is clearly an important metric to track.

I intend the SHI is to be predictive, anticipating where the economy is going – not where it’s been. Thereby giving us the ability to take action early. Not when it’s too late.

Taking action: Keep up with this weekly BLOG update. If the SHI index moves appreciably – either showing massive improvement or significant declines – indicating expanding economic strength or a potential recession, we’ll discuss possible actions at that time.

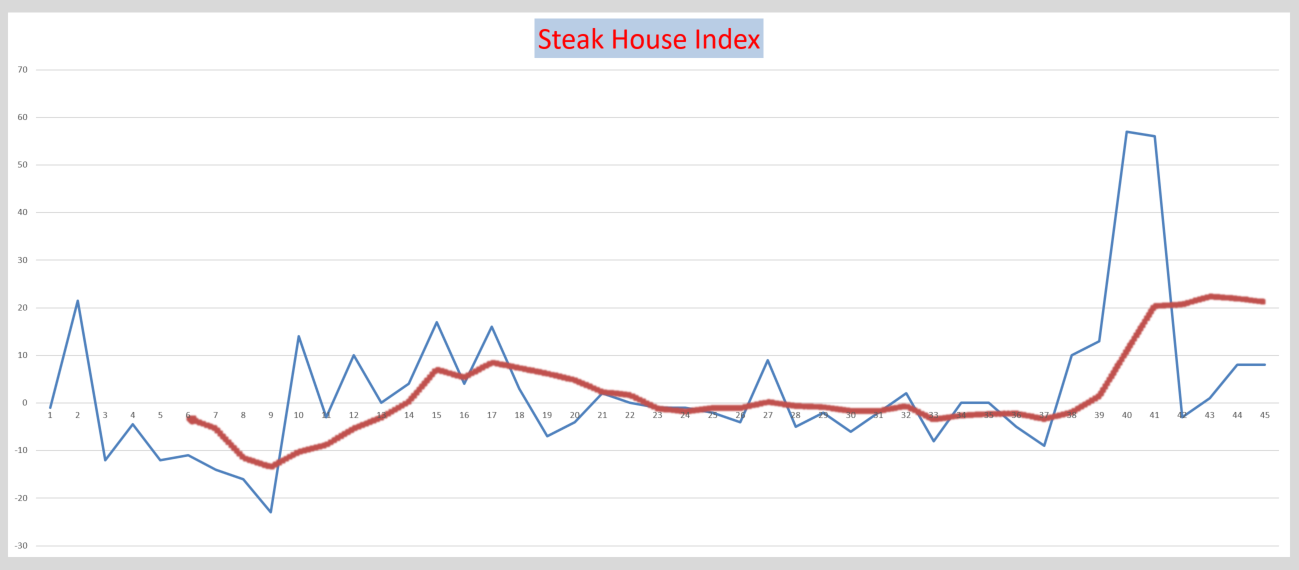

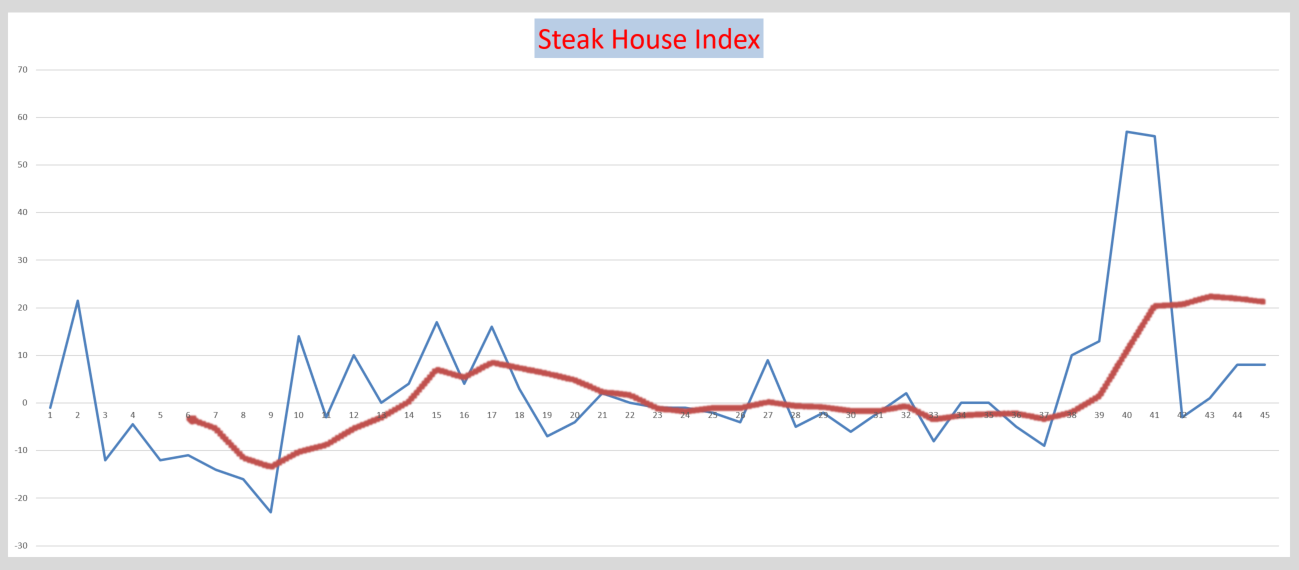

The BLOG: Let me jump right in: Take a look at the two (2) graph lines below. The BLUE line shows SHI movement during the 45 weeks we’ve been tracking the SHI. The RED line shows the ‘6-week moving average.’

Right away, it’s easy to see the up-trend. Clearly, the SHI indicates very strong consumer demand for the high-cost steak & potatoes sold at our elite Orange County eateries. There can be no doubt: If the SHI is an accurate barometer of the ‘consumer spending’ component in the GDP, then GDP growth is accelerating:

As mentioned above, this week’s reading is a positive 8. The same as last week’s reading. What might surprise you, however, is the data generating this reading:

Yes! The Capital Grille is BOOKED at 6:00 pm on Saturday! I’m not 100% certain, but with the exception of two prior December readings, I don’t believe we’ve seen an unavailable time slot at the Capital Grille. Fabulous! Here is the SHI trend since inception:

Speaking of the GDP, the BEA will release the Q4 “advance estimate” on Friday. Then on February 28th, they will release the “second estimate” … and on March 30th, the “third estimate” for both Q4 and the entire year of 2016.

Yes, the BEA gives us 3 ‘estimates’ for each GDP reading. Why? According the the BEA:

“BEA releases three vintages of the current quarterly estimate for GDP: “Advance” estimates are released near the end of the first month following the end of the quarter and are based on source data that are incomplete or subject to further revision by the source agency; “second” and “third” estimates are released near the end of the second and third months, respectively, and are based on more detailed and more comprehensive data as they become available.”

This is why the SHI is so important: We won’t know the “true” Q4 GDP reading until March 30th! I don’t want to wait. Do you?

And so today’s good news is, yes, “Steady as She Goes” describes our current state. Consumer spending remains robust. Our US economy is strong. GDP growth remains positive.