SHI Update 1.30.19 – Weighing the Data

SHI 01.23.19 – Can This Be Fixed?

January 23, 2019

SHI 02.06.19 – The White House and The SHI

February 6, 2019” … the case for further (FED funds) interest rate increases is weakening.”

… said FED Chairman Powell a few moments ago. Below is the written comment from within the FOMC statement:

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

And on the topic of the FED balance sheet, their written comment was:

” … the Committee is revising its earlier guidance regarding the conditions under which it could adjust the details of its balance sheet normalization program.”

In his press conference, Powell added, “We will patiently wait for the data …. “

OK … got all that? Clear? Permit me to interpret.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will continue to be true for years to come.

Is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.66 trillion. In Q3 of 2018, nominal GDP grew by 4.9%. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

Patience is back in vogue at the FED. The FED is no longer using the ’25-basis-point-rate-increase-every-quarter’ play-book. They are looking at the data, considering the data, pondering the data, weighing the data, and then, when the time is right, making a decision. Right: This is about as exciting as watching wine breathe. But hey, that’s OK. I’m really pleased they have decided to sit and watch and weigh. That’s a good thing. The rate “tightening cycle” is on pause. Good.

And soon, the “balance sheet runoff” will probably be as well. Let me refresh your memory: Between 2009 and 2014, the FED purchased assets — Treasury obligations and ‘mortgage backed securities’ — and increased the assets on their balance sheet to about $4.5 trillion. This figure was quite a bit higher than the prior peak of about $800 billion in 2007. Now, over the past two years, as various securities matured, they did not use those funds to buy new securities. They accepted repayment, and used the cash received to reduce the size of the balance sheet. Today, it’s back to about $4 trillion.

For years now, market participants have debated how small the FED would permit the balance sheet to become. The FEDs answer, today at least, seems to be between $3.5 and $4 trillion. Again, good. For both technical and financial reasons, this is a good thing. You may recall prior Steak House Index blog updates where I discussed one Treasury benefit from a large balance sheet — about $100 billion a year of income is the answer. That amount is nothing to scoff at — especially when the Treasury is looking to fund a deficit of almost $1 trillion this year. That’s a nice chunk of change.

$100 billion would buy a lot of expensive steaks! At Mastros, I think one could easily take 10 of their best friends to dinner and keep the check under that figure! 🙂

Let’s see how our friends, the elegant eateries, are holding up this week:

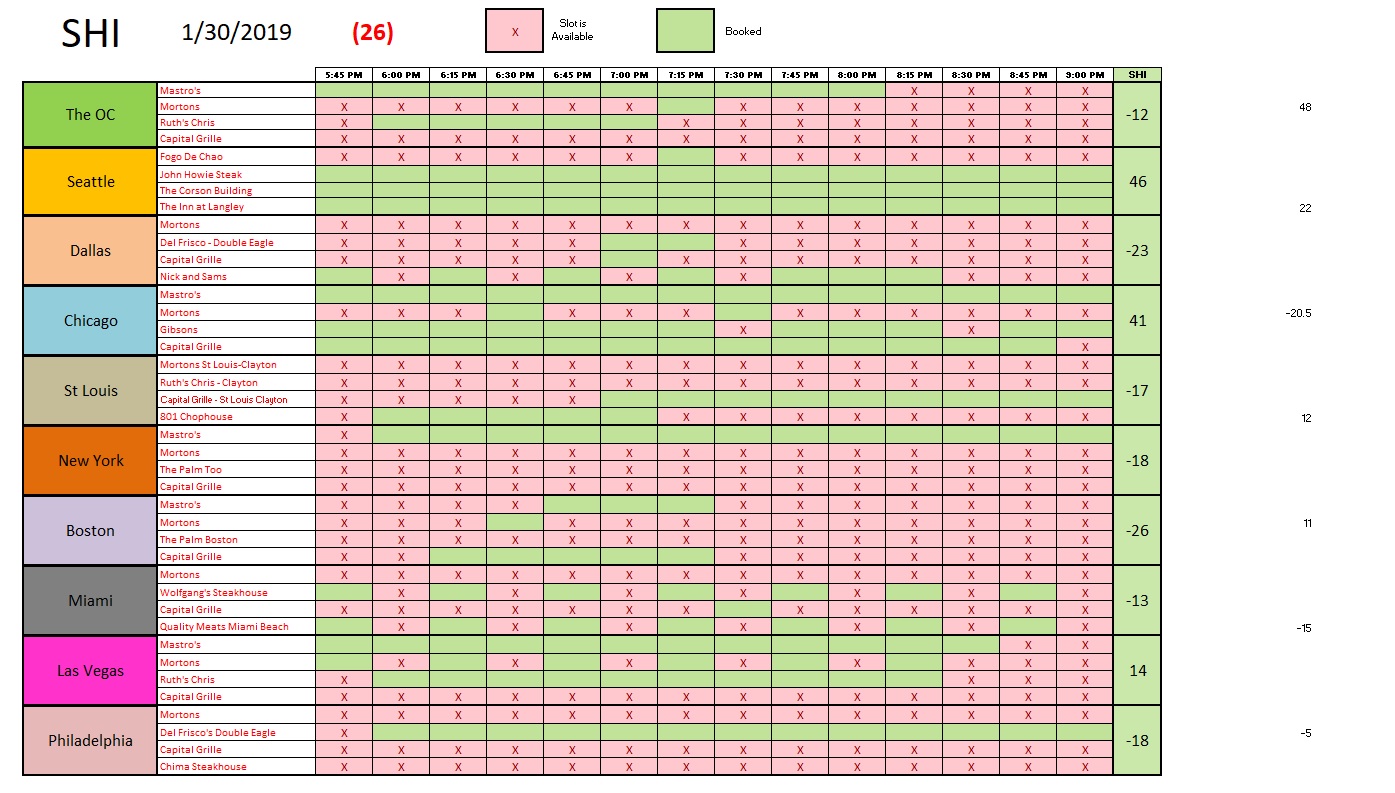

Mastros could use some help. At least here in the OC. Our local SHI slipped meaningfully … and as you’ll see below, Mastro’s Ocean Club in the beautiful Crystal Cove has openings from 8:15 and beyond. This is very unusual. The FED might want to add some “steak assets” to the balance sheet. Mastros would be quite happy to take their money. 🙂

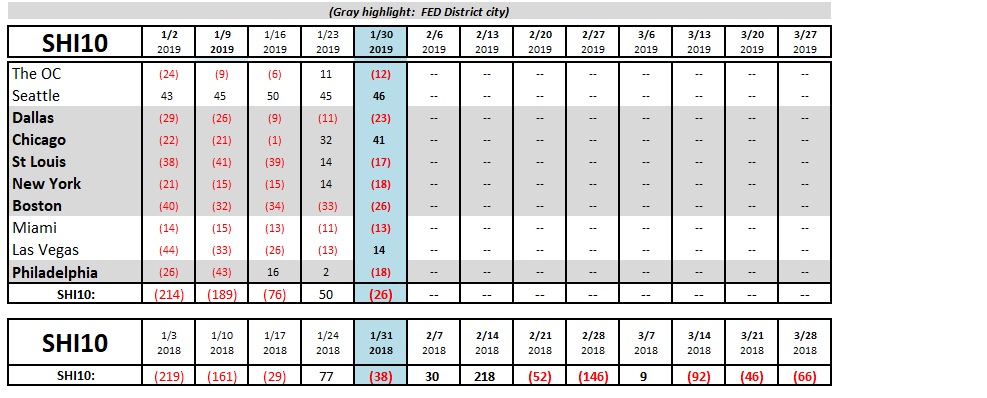

But once again, this week’s SHI10 is consistent with reservation demand in 2017 — after a near-term peak last week, reservation demand this week has shrunk in consistent trend. Here are this week’s results:

The stock markets were very happy with the FEDs comments today. At the time I published this BLOG, the DOW was up about 470 points. A big move.

Does this mean everything is good once again? That we should have no fears or concerns about the U.S. or the global economy? Nope. Those concerns are unabated. If anything, today I’m more concerned about growth deceleration in China and the EU than I was last week. And, in fact, I believe the FED shares these concerns. This is some of the “data” they are watching.

And so, we too will watch. And weigh. And wait. In just a few months, our economic expansion will become the oldest “kid on the block” — the longest recovery ever. I’m confident we will set a new record here. And from there we’ll wait and see.

– Terry Liebman