SHI 7.10.19 – Superforecasting and Inflection Points

SHI 7.3.19 – A Celebration is in Order

July 3, 2019

SHI 7.24.19 – Facebook and the 5 Billion

July 24, 2019“Joe Weisenthal suggests we relax. He thinks we’re overly worried about the next recession.”

In a conversation with Joe Weisenthal, one of the ‘podcast stars’ of Odd Lots and an author for Bloomberg, Philip Tetlock — Professor at the University of Pennsylvania — commented he believes we’re missing the point. And the point we’re missing, in this case, is the inflection point.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $21 trillion. In Q1 of 2019, nominal GDP grew by 3.8%…following a 4.1% increase in Q4, 2018. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close. We can’t forget about the EU — collectively their GDP almost equals the U.S. So, together, the U.S., the EU and China generate about 2/3 of the globe’s economic output. Worth watching, right?

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

According to Tetlock, ‘super-forecasters’ not only possess excellent data, but they are clever. So clever, he suggests, that a ‘clever’ amateur forecaster is often more accurate than the pros. If you want to read more on this topic, pick up his book, “Superforecasting: The Art and Science of Prediction.”

Alternatively, I’ll offer you the Cliffs notes version. 🙂

Tetlock told Joe Weisenthal people often make the error of overestimating the frequency of a topic’s “inflection point.” For example, Joe paraphrased Tetlock’s comment: “…geopolitical forecasters are likely to overstate the odds of an imminent regime change or coup in any given country, despite those events being extremely rare.” Interesting.

Joe commented further on the Tetlock interview: “Part of the problem is that simply saying ‘the status quo will probably persist for the time being’ comes off as boring and doesn’t win you any glory and doesn’t get you much attention in the media.

Anyway, I was thinking about this with respect to the market and the economy right now. The post-crisis era has been characterized by an exceptionally long, stable period of moderate growth and cool inflation. It’s a cliche, but it’s basically been a “goldilocks” environment for investors. Right now we’re in a period where people are starting to wonder if this is coming to an end. The fact that the Fed might ease policy is one reason they’re anxious. The surge in negative-yielding sovereign debt is another. The trade war is also a huge wild card. And yet on the flipside, if you look at Friday’s jobs report, with 224,000 jobs created and wage growth failing to accelerate, it certainly looks like the stable and cool economy remains with us. While there are all kinds of crosswinds and headline risk and everything else at the moment, perhaps people should be open to the idea that really not much has changed from what we’ve seen virtually non-stop since 2009.”

Hmmmm … so, in Joe’s opinion, not much has changed since 2009? Of course, factually this is completely inaccurate. Much has changed: Interest rates, the DOW, FED commentary, consumer confidence, the President, levels of US and international growth. But I think his point is that while many individual data points have changed, the overall picture has not. At least, per Joe, not appreciably.

Is it possible that the more things change, the more they stay the same? Is it possible all the “noise” we hear every day — from politicians, CNBC, the FED, the Wall Street Journal, etc. is just that? Noise? And that nothing appreciably is different? What an interesting perspective. Certainly one that bears more thought and consideration.

And while you think on that idea, relaxing as Professor Tetlock suggests, let’s grab a steak and a glass of cab. This week, we see a bit of improvement in the SHI10:

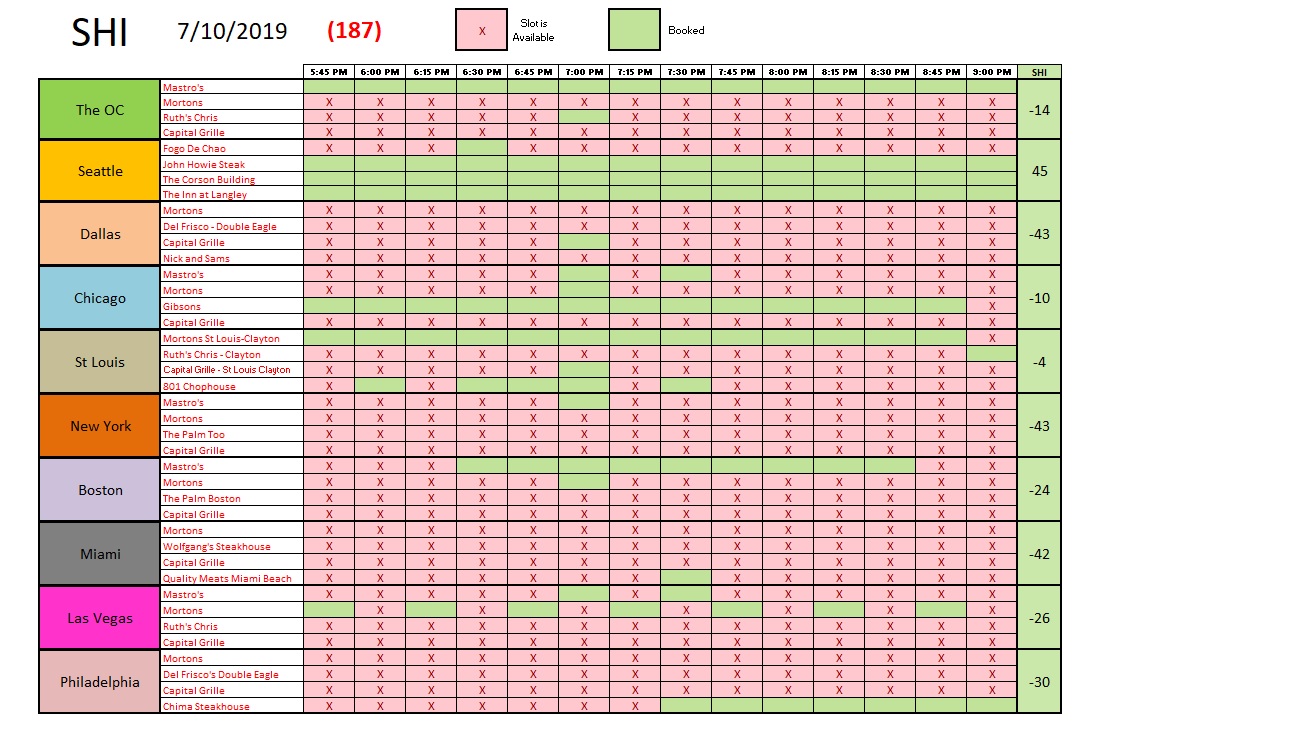

The grid above, with a reading of negative (187), is a bit better, but still consistent, with recent readings. And did you see the touch of green in the Miami section? For the first time in over a month, Miami has a fully-booked time slot! Joe Weisenthal may suggest not much has changed — but this is an exciting development for Miami! 🙂

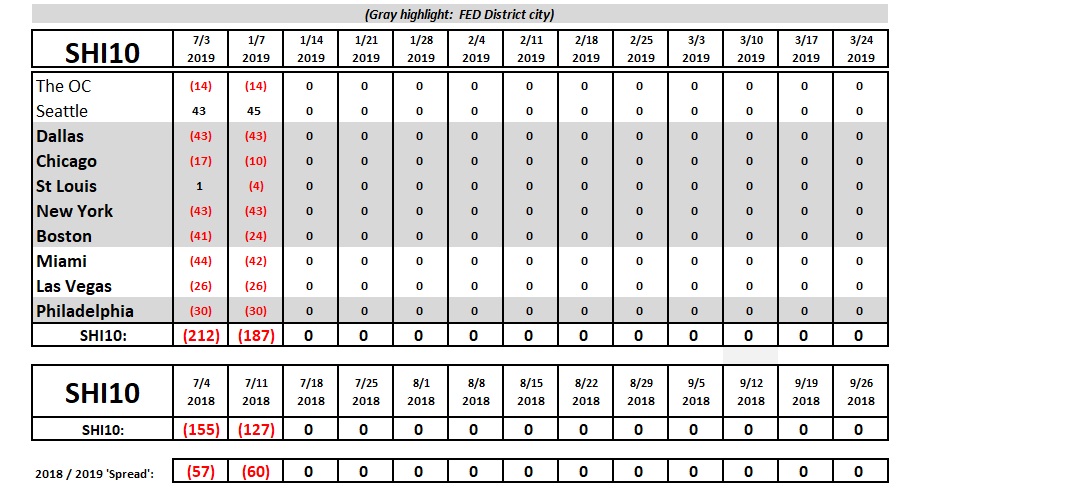

Let’s take a look at the trend report:

Yep. Not much has changed. Meaning across the board, reservation demand still remains weaker than a year ago.

So the question remains: Is Joe right? All the noise aside, is everything pretty much the same over the past 10 or so years? Is Professor Tetlock right? Are we missing the inflection point? Has it not yet arrived? Will we be clever enough to see it when it does?

Great questions. I suggest we all engage in “inflection reflection” and figure it out. That’s what I plan to do next week. With steaks and wine in hand, I’ll be on vacation. So, unfortunately, the SHI will take a 1-week hiatus. But rest assured, while I relax and unwind, I’ll be pondering these questions from Joe and the Professor.

Thanks.

– Terry Liebman