SHI 5.22.19 – Trade, Tariffs and Inflation

SHI 5.15.19 – The Truth About This Trade Thing

May 15, 2019

SHI 5.29.19 A Tale of Two Viewpoints

May 29, 2019“Let’s take a look at tariffs thru the lens of inflation.”

Inflation is arguably the FEDs most crucial metric. While the FEDs formal target is 2% per annum, the tolerable range is probably about 1.5% on the low-end and 2.5% on the high-end. It’s a tight range. Any larger deviation would likely force the FED to take monetary action.

$250 billion of imported goods from China are now subject to a 25% tariff. Which begs these questions:

- What impact will the 25% tariff on $300 billion of Chinese goods have on US prices?

- What impact will the tariffs have on US inflation?

- What impact with the tariffs have on the US economy?

Let’s take a closer look.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $21 trillion. In Q1 of 2019, nominal GDP grew by 3.8%…following a 4.1% increase in Q4, 2018. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close. We can’t forget about the EU — collectively their GDP almost equals the U.S. So, together, the U.S., the EU and China generate about 2/3 of the globe’s economic output. Worth watching, right?

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

Let’s start here: What impact does this 25% tariff have on the price of “stuff” we buy at Walmart, Kohl’s, and Home Depot?

First, let’s do the math. 25% of $250 billion equals $62.5 billion. That’s the maximum annual amount the US Treasury will receive from this round of tariffs on Chinese goods. Until recently, Chinese tariff levels were 25% on $50 billion plus a tariff rate of 10% on $200 billion. Now, this whole group is subject to the 25% tariff rate.

How much have we collected already? According to a recent article in Reuters, “Customs duties receipts in the first half of the current fiscal year, which began on Oct. 1, have shot up by 89 percent from a year ago to $34.7 billion, data from U.S. Treasury shows.”

Of course, this number includes tariffs on goods imported from other countries, too. But the math is clear: The US Treasury could very well collect $80 to $100 billion during the next 12 months. (A ‘positive’ for the US Treasury.) But here’s the million-dollar-question: Will the importers/retailers be able to pass along the tariff “cost” to consumers?

Perhaps not. Here are some quotes from an article in today’s WSJ entitled, “Big Retailers’ Sales Lag as They Gird for Tariffs”:

- Home Depot finance chief Carol Tomé said the home-improvement chain estimates it will spend about $1 billion more to buy goods with the 25% tariffs in place, coming on top of the roughly $1 billion in costs added by the 10% tariff.

- Kohl’s, which imports about a fifth of its goods from China, said Tuesday that additional costs related to rising import tariffs prompted it to lower its guidance for the year.

- Last week Walmart executives said they will likely raise some prices in the face of tariffs, but are managing cost increases product by product.

But be assured they will try. When asked if they will pass the cost of the tariff on the the consumer, many retailers have commented such an outcome is “unavoidable.”

So, for the moment, let’s assume they can. Let’s assume 100% of the $100 billion annual tariff is paid by the US consumer.

What is the maximum potential impact on prices? Well, that math is pretty easy. Remember that about 65 to 70% of our annual GDP is the result of consumer spending. Meaning about $14 trillion of our $21 trillion GDP is attributable to the consumer’s consumption of goods and services. What impact would a $100 billion price increase have on $14 trillion? Well, let’s divide 100 into 14,000 and we get about 0.7%. So, conceivably, if the tariffs TOTALED $100 billion and ALL of the tariff were passed thru to consumers in the form of increased pricing, the impact on the cost of goods and services might be 0.7% per year.

Now we need to ask: What percentage of the CPI is comprised of ‘goods and services?’ Well, let’s approach it this way: The things that are unlikely to be impacted by the tariffs — housing, medical care, recreation, and education/communication — combined, account for almost 2/3 of the CPI ‘basket.’ Around 37% of the CPI basket of ‘stuff’ fall into the ‘goods and services’ slot. Multiplying 0.7% by .37, we get about 0.26%.

Thus, the maximum inflation impact — assuming ALL the tariffs are collected and ALL the cost is passed on to the consumer — is less than 0.3%. The actual impact is certain to be much less. My guess? Probably closer to 0.1%. Not much at all. I’m more concerned about the general impact on our economy. Why?

Turning back, for the moment, to the comments from Home Depot, Kohl’s, and Walmart, it seems very unlikely retailers will be successful in passing all the tariff cost to the consumer. Some portion of the cost is likely to be paid by the retailer. Which will adversely impact the level of their earnings. Which, in turn, will adversely impact their stock price.

That’s why the stock market is feeling pain from the trade war. Are the steakhouses feeling the pain, too? Let’s head to Mastros!

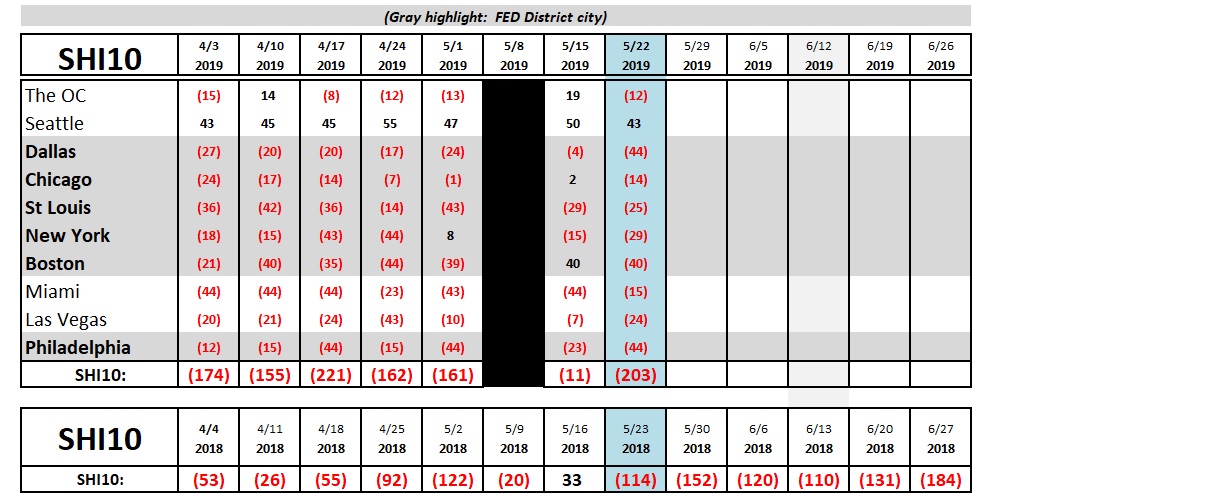

Perhaps. This week’s SHI10 is a rather weak negative (203). When compared to this same week last year, reservation demand in our pricey eateries looks a bit muted. Take a look:

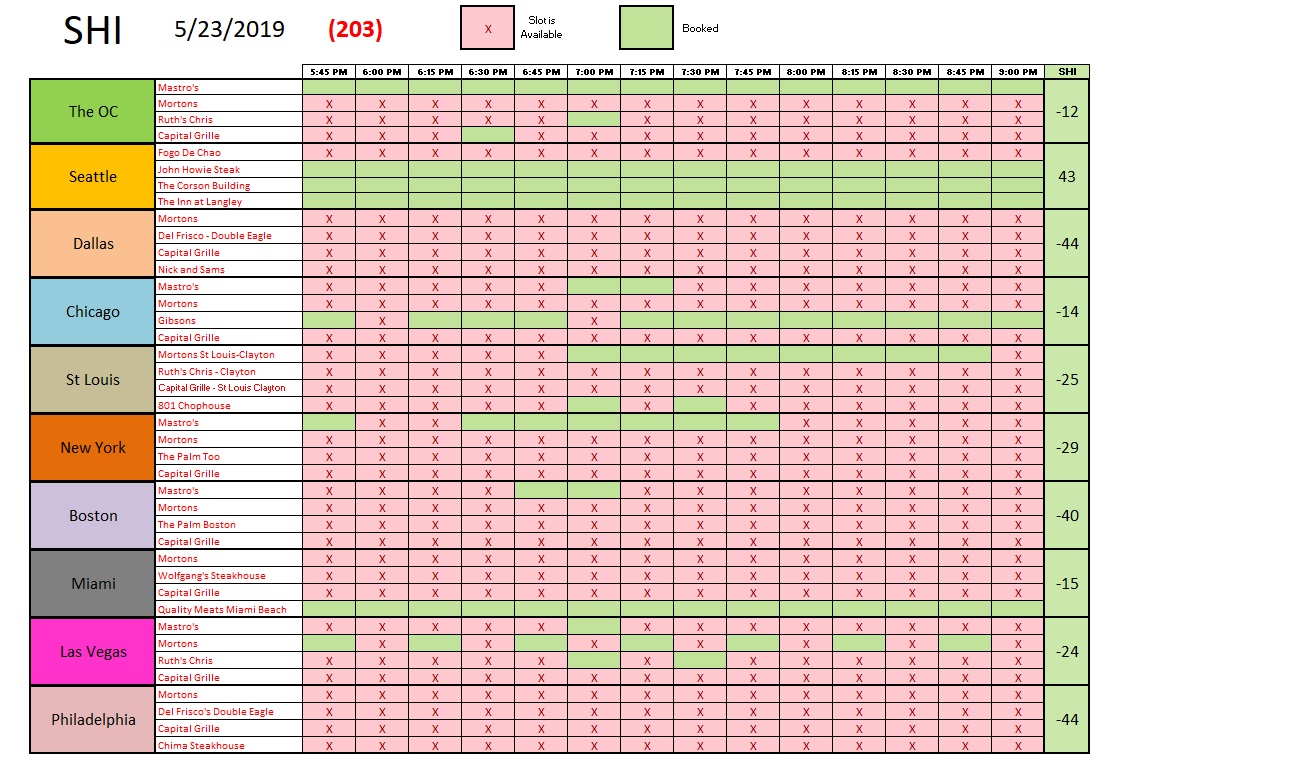

Frankly, it’s hard to tell if the slowdown in reservation demand is driven by general economic weakness, or a more temporary lull caused by the trade war or some other ‘transient’ metric. But whatever the reason, our steakhouses have plenty of open slots this weekend. Here are the weekly numbers for all 40 restaurants in our ten SHI markets:

There’s a whole lot of red on that chart. Unlike the vibrant ‘red’ of a rare steak, I’m not a big fan of the red on this chart. For whatever reason, tariffs, trade, fear, or something else, our expensive steakhouses are not as popular as in prior weeks.

Could this be an indication of future economic weakness? It’s too early to tell. But we’ll keep watching.

– Terry Liebman