SHI 4.24.19 – And The Winner Is ….

SHI 4.17.19 – The FED: Quantitative Neutrality

April 17, 2019

SHI 5.1.19 – The SHI is the Place!

May 1, 2019“The first release of Q1, 2019 GDP is scheduled for Friday, April 26th. Who is most accurate? The NY Fed ‘Nowcast,’ the Atlanta Fed ‘GDPNow’ or the Liebman SHI? The excitement is palpable! And the winner is …. ”

This calendar quarter, the contestants for the MOST ACCURATE GDP FORECASTER are:

- The Atlanta FED: As of 4/19, they are projecting a Q1, 2019 GDP growth rate of 2.8%.

- The NY FED: On that same date, the NY FED opined the growth rate will be 1.37% for our first quarter.

- The Liebman SHI: The Liebman SHI has been strangely silent, failing to offer a precise forecast … clearly that guy is a chicken, weak and simpering, not worthy of writing about expensive steaks from opulent eateries! Where’s the beef, man! Come on, throw in!

OK … ok … let me shed my chicken suit and jump into the fray. My GDP growth forecast is actually between the two quoted above. Are you surprised? Did you expect a lower forecast from me? Read on … I’ll share my reasons below.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.89 trillion. In Q4 of 2018, nominal GDP grew by 4.6%…following a 4.9% increase in Q3. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close. We can’t forget about the EU — collectively their GDP almost equals the U.S. So, together, the U.S., the EU and China generate about 2/3 of the globe’s economic output. Worth watching, right?

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

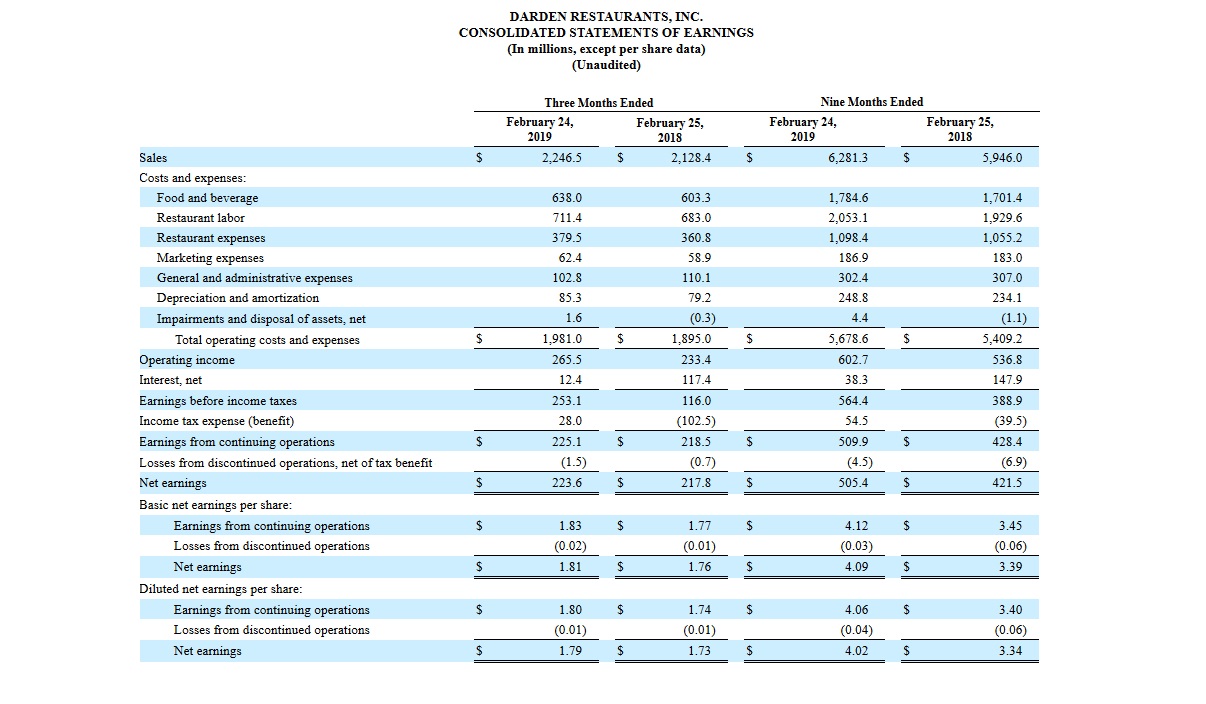

Darden, the owner of ‘The Capital Grille,’ is a publicly traded restaurant company:

“Darden Restaurants, Inc. is a full-service restaurant company. The Company owned and operated 1,536 restaurants through its subsidiaries in the United States and Canada, as of May 29, 2016. The Company’s segments include Olive Garden, LongHorn Steakhouse, Fine Dining (which includes The Capital Grille, and Eddie V’s Prime Seafood and Wildfish Seafood Grille (Eddie V’s)) and Other Business (which includes Yard House, Seasons 52, Bahama Breeze, consumer-packaged goods and franchise revenues). As of May 29, 2016, the Company also had 50 restaurants operated by independent third parties pursuant to area development and franchise agreements. Olive Garden’s menu includes a range of authentic Italian foods featuring fresh ingredients and a selection of imported Italian wines. LongHorn Steakhouse restaurants feature a range of menu items, including fresh steaks and chicken, as well as salmon, shrimp, ribs, pork chops, burgers and prime rib.”

Wow, 1,536 restaurants in total … that’s a lot of restaurants. And here at the SHI we know Darden’s ‘flagship’ pricey steakhouse — the Capital Grille — is often fully available on Wednesdays. Unlike Mastros. Which is typically fully reserved. Which begs the question: How is Darden doing? Let’s take a peek.

Here are financial results, gleaned from the 10-Q filed with the SEC just weeks ago:

In the prior 9-months, Darden generated total revenues of over $6.2 billion, up 5.6% from the same 9-month period the prior year. Clearly, someone is eating at their restaurants! 🙂

Darden’s revenue growth makes a positive economic comment: Folks are eating out as much — or slightly more — than they did in the prior year. But I find their operating expenses even more interesting: While both ‘F&B’ costs and ‘Restaurant expenses’ increased about 4% during that period, Restaurant labor costs increased at a much faster clip of 6.4%.

With continued top- and bottom-line revenue growth — Darden has also seen some solid stock value growth over the past 10 years:

What’s my point?

Simply this: Last week, after reviewing a basket of concerning data, I suggested the economy may be slowing more than I previously thought … but recommended we all continue to “sit on the fence” a bit longer … and gather a bit more data.

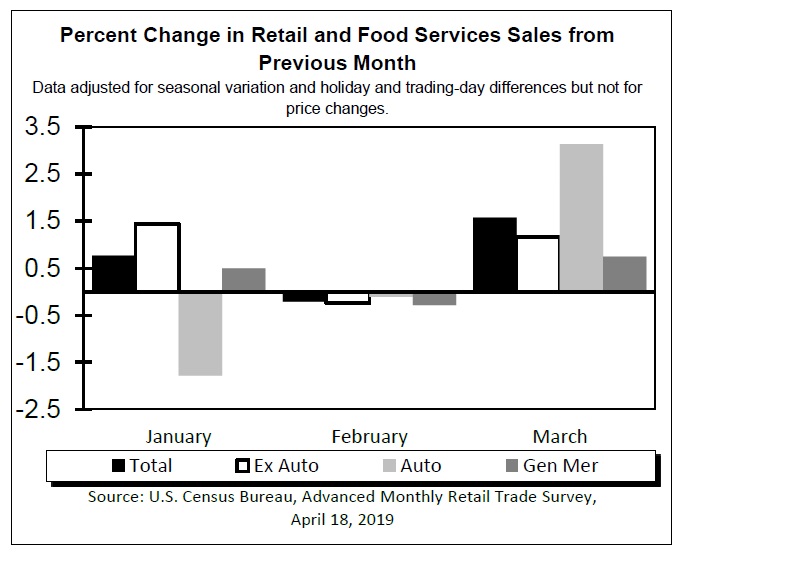

Well, today we have a bit more data: March Retail Sales (released the day after my blog post) was a barn-burner. Here’s a 3-month graph … take a look:

The downward trend completely reversed itself in March. Retail sales came back with a vengeance. And take a look at new auto sales: UP 3.1% from February. A huge comeback. Here’s a bit of interesting trivia for you: The only segment on the retail sales report that declined during March was ‘sporting goods, hobby, musical instrument & book sales.’ Clearly, during March, folks decided to eat out, buy cars and avoid working out. 🙂

Let me get back to the wage cost increase at Darden’s. A 6.4% YOY increase is quite large, when compared to compared to the general increases reflected in the BLS ‘Employment Situation Summary’ released on 4/5. Here was the BLS comment:

In March, average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents to $27.70, following a 10-cent gain in February. Over the past 12 months, average hourly earnings have increased by 3.2 percent.

Ironically, the 6.4% increase at Darden’s is exactly double the wage increase across the economy as a whole. Meaningful? Or simply an aberration? Hmmm…. We’ll be watching this closely, as wage inflation is the FEDs greatest area of focus at the moment.

OK…back to my Q1, 2019 GDP growth forecast. Ready? Drumroll please ………………

1.65%

Yep. Lukewarm, for sure. But not dismal. Frankly, before this latest retail sales report, considering the direction of the SHI, I would have forecasted below 1%. But I think the combination of marginal consumer consumption, robust government spending, adequate net-exports, most likely some inventory reduction, and lukewarm investment in residential and non-residential structures, I’m expecting our Q1 GDP growth rate right around 1.65%. The U.S. economy, I think, is still chugging along.

We’ll know the winner on Friday!

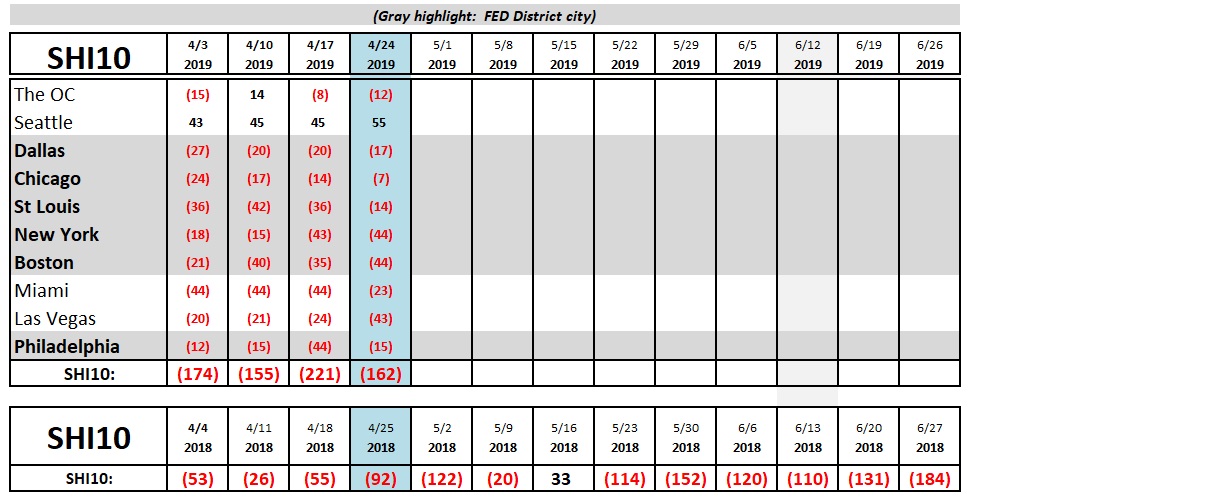

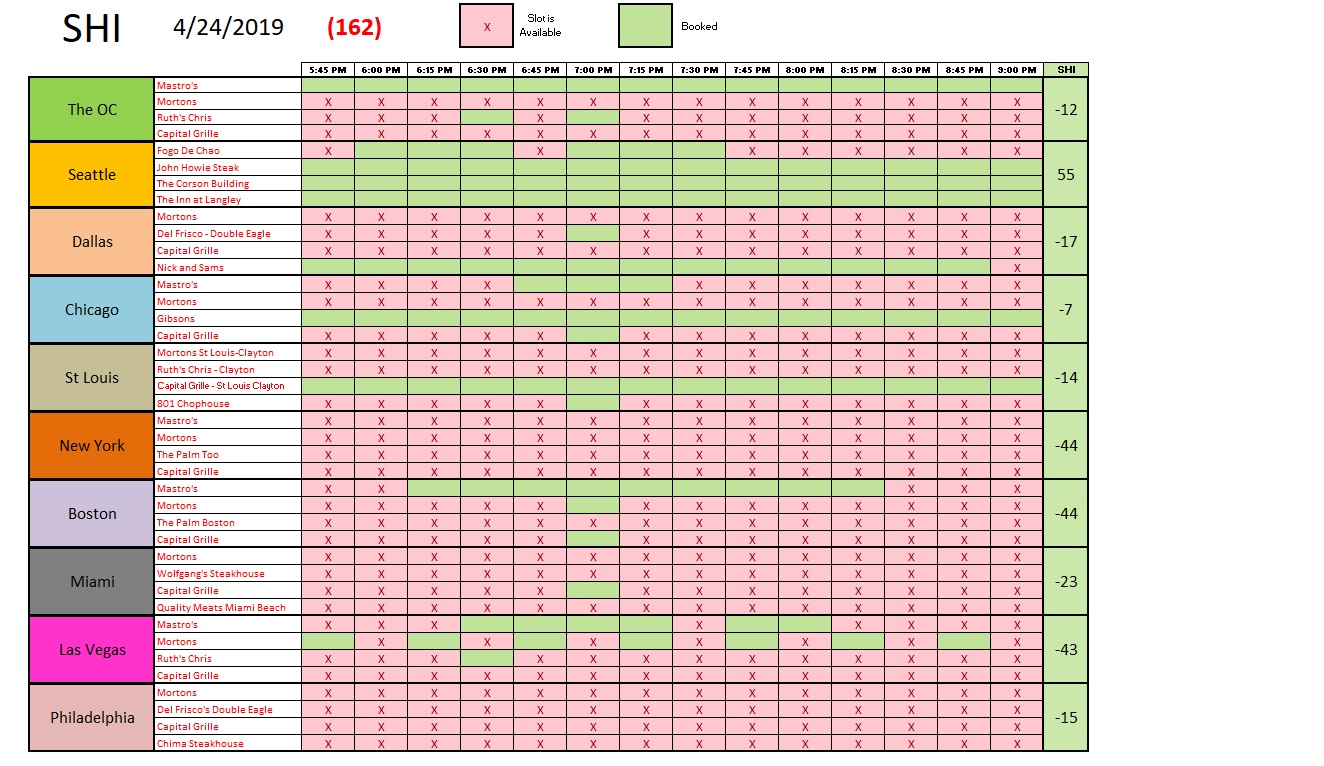

Let’s take a look at this week’s SHI10:

OK…well, the SHI is looking a bit better, too. This week, we see a 70 point spread between the 2018 and the 2019 reading. This is much better than last week. Not robust by any measure, but at least some of our expensive steakhouses are experiencing reasonable reservation demand for the upcoming Saturday evening.

Here are the individual restaurant results:

I remain on the fence … unconvinced our economy has much momentum in either direction. Friday’s ‘advance’ Q-1 GDP report will be very instructive, and we’ll take a deep dive into the data in next week’s SHI update.

Thanks for tuning in.

– Terry Liebman