SHI 4.17.19 – The FED: Quantitative Neutrality

SHI 4.10.19 – Steaks, Nighttime Lights and the GDP

April 10, 2019

SHI 4.24.19 – And The Winner Is ….

April 24, 2019“The FED has a 3rd gear: Quantitative Neutrality. We are now firmly in 3rd gear.”

We all know the meaning of ‘Quantitive Easing’ — or QE — right? And we know the FED was recently engaged in ‘Quantative Tightening’ — by (1) raising interest rates and (2) shrinking the balance sheet. Well, the FED has a 3rd gear: Quantitative Neutrality.

They would call this condition “data dependency,” but, if you think about it, it’s really a third alternative. Remember, doing nothing is a conscious choice. And that’s what the FED is choosing to do right now. Nothing. They are leaving interest rates as is. And in a few months, they will cease reducing the size of the FED balance sheet at around $3.9 trillion. Once there, they will leave it as is.

They are sitting on the fence, watching. Waiting. But as you’ll see below, the SHI suggests they should be acting. Not watching. Not waiting.

Why?

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.89 trillion. In Q4 of 2018, nominal GDP grew by 4.6%…following a 4.9% increase in Q3. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close. We can’t forget about the EU — collectively their GDP almost equals the U.S. So, together, the U.S., the EU and China generate about 2/3 of the globe’s economic output. Worth watching, right?

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

The FED is in neutral. Arguably, they are as likely to raise or lower interest rates the next time they “move.” They have made their stance patently clear: You will find this quote on Page 13 of the FEDs “Minutes of the Meeting of March 19-20, 2019“:

“More generally, members noted that decisions regarding near-term adjustments of the stance of monetary policy would appropriately remain dependent on the evolution of the outlook as informed by incoming data.”

In plain-talk, this means they are sitting on the fence, waiting. Doing nothing. Why? Because the FED believes our economy — in fact, the global economy as well — is at an inflection point. By putting interest rate increases and balance sheet size reduction “on hold,” the FED is broadcasting this message:

OUR ECONOMY IS ON FIRM FOOTING. WE ARE ONLY A LITTLE WORRIED ABOUT THE FUTURE. SO WE HAVE DECIDED TO DO NOTHING FURTHER RIGHT NOW. HAVE NO FEAR: WE HAVE OUR FINGER ON THE PULSE OF THE ECONOMY.

Got it. Thank you, Mr. Powell. Message received.

But we track the SHI to gain greater financial and economic insight, beyond what the FED may be saying today. And the SHI, I believe, is telling us a very different story.

Remember the essence of the SHI, or Steak-o-nomics, is designed to be a predictive gauge of future economic performance of the U.S. economy. The FED message above is more of a ‘current state’ than a prediction. Remember: About 2/3 of U.S. GDP is generated by consumer consumption. Which means, far and away, consumer spending/consumption is the single most important economic indicator – one that bears close scrutiny when attempting to gauge the direction of our economy.

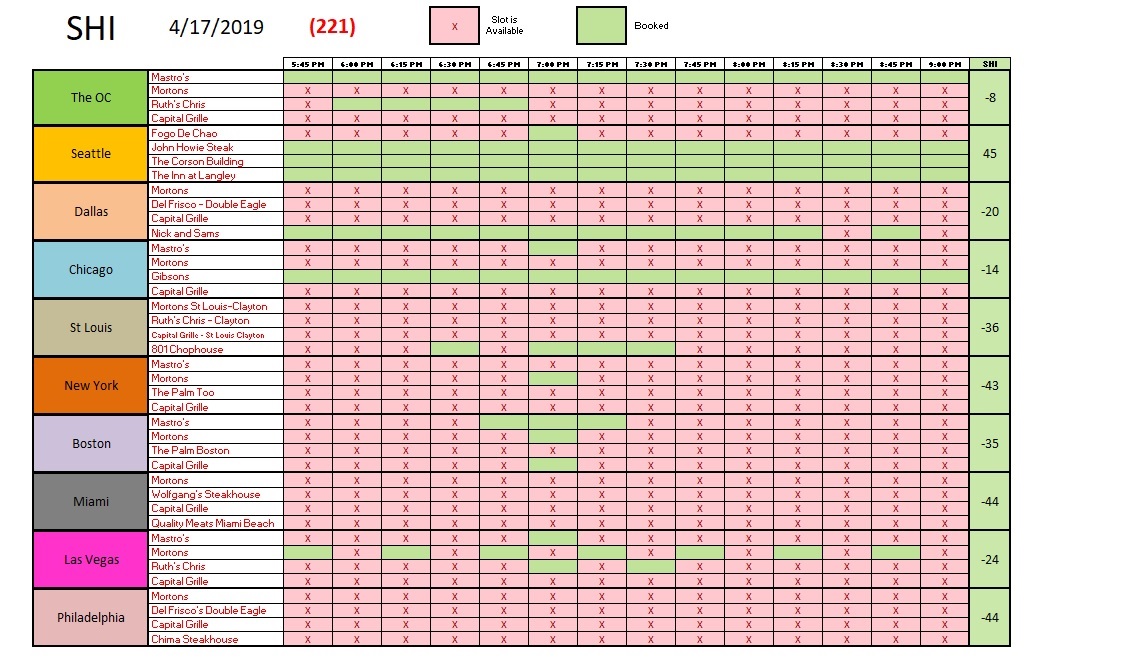

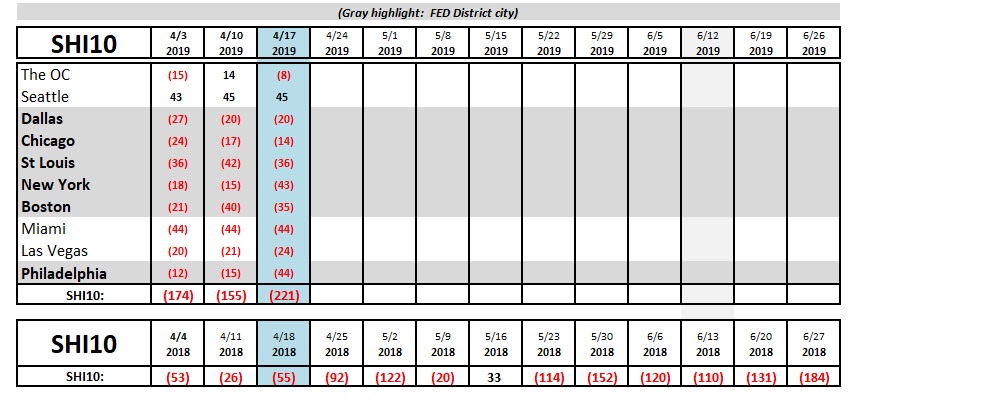

And the number of available reservation ‘slots’ at our expensive steak house restaurants is suggesting economic performance is tuning decidedly negative. For five (5) weeks now, the SHI10 readings have been far worse than during the same period in 2018. Take a look at the sea of red in this week’s SHI10:

I’m seeing a lot of ‘red’ — available reservation slots this Saturday evening, even at the highest demand times. Far more than we should be seeing right now. Even worse, for a full month now, the SHI has been flashing warning signs, suggesting the U.S. economy is slowing much faster than the FED believes.

Consider this: The SHI chart above is arranged geographically. West at the top … east toward the bottom. With the exception of Las Vegas, of course. The ‘green’ slots are fully booked reservation time slots. The red are available for reservation. This week, the ‘west’ shows fair reservation demand. Including Las Vegas. But the ‘east’ does not. The east may be slowing faster than the west.

And as we see from the trend report below, our 4/17/2019 reading of negative <221> is significantly weaker than the 4/18/2018 SHI reading. One year ago, reservations at our pricey steakhouses were in much greater demand. Not today. Today, you have your pick of the most popular time slots at many expensive steak houses across the U.S.

Is the SHI an accurate and meaningful barometer? Well, the jury is still out on this question. Perhaps a better question is this: Is the SHI a meaningful indicator? That question I would answer with a ‘yes.’ Consider these data in support:

- By historic standards, consumer spending as measured by the Commerce Department was very weak in December, January and February. (https://www.census.gov/retail/marts/www/marts_current.pdf)

- Personal consumption expendatures (PCE), when measured by the Bureau of Economic Analysis at the end of last month, was almost flat month over month. And the PCE index (excluding food/energy) slid down to 1.8% (https://www.bea.gov/news/2019/personal-income-february-2019-personal-outlays-january-2019)

And the SHI is suggesting folks are less willing to part with their hard-earned cash at expensive steak houses.

So what do I suggest you do? The same thing the FED is suggesting you do: Sit on the fence for a bit longer. Let’s see how this develops. But I think I’m growing more concerned than the FED. I think our economy may be slowing faster than we’re being told.

- Terry Liebman