SHI 3.20.19 – Antifragile: Things that Gain from Disorder

SHI 3.13.19 – A Serious Crisis

March 13, 2019

SHI 3.27.19 – Why Inflation Matters

March 27, 2019“I’m reading a very unique book.”

This book is not for everyone. But I believe it’s a fascinating read. The author is Nassim Taleb and the book’s title, “AntiFragile: Things that Gain from Disorder.”

Antifragile, per the author is the polar opposite of fragile. Something very breakable, very weak is fragile. Something ‘antifragile’ is resilient, flexible, adaptable and unbreakable. I mention this concept today because of the “college admissions scandal” we’ve all read about … all heard about. And the parents who allegedly paid millions of dollars to pave the way for their children to be accepted at top colleges, colleges that would have otherwise rejected them. Taleb coins the term “fragilista” — a group or individuals which are fragile. And Ironically, Taleb comments about “soccer-mom fragilista” early in the book. I believe we can include the “scandal” parents in an uber-soccer-mom category. The NY Times had another, but similar, perspective. They refer to the “scandal” parents by a different name: “Road-plow parents.” These are parents who ‘plow the road’ ahead, removing all obstacles, so that their children have an easier time achieving their objectives and feel less (or no) pain from rejection or failure.

Here’s a quote I really enjoyed from that NY Times article:

“It’s not a parent’s job to prepare the road for the child. It’s the parent’s job to prepare the child for the road.”

I couldn’t agree more.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.89 trillion. In Q4 of 2018, nominal GDP grew by 4.6%…following a 4.9% increase in Q3. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close. We can’t forget about the EU — collectively their GDP almost equals the U.S. So, together, the U.S., the EU and China generate about 2/3 of the globe’s economic output. Worth watching, right?

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

The FED just finished their March meeting. The left rates unchanged. In fact, they are now predicting

ZERO RATE HIKES

in 2019. Good. Perhaps we’ll actually see a the FED negotiate a “soft landing” for the U.S. economy?

And they issued this statement:

“Information received since the Federal Open Market Committee met in January indicates that the labor market remains strong but that growth of economic activity has slowed from its solid rate in the fourth quarter.”

Economic activity has slowed.

Here are the data from their press release entitled, “Balance Sheet Normalization Principals and Plans“:

- They plan to slow the speed at which they are reducing the FEDs $4 trillion balance sheet.

- Effective in May, 2019, they will ‘cap’ the reduction at $15 billion per month — down from $30 billion.

- Effective in October, 2019, they will no longer reduce the size of the balance sheet.

On Feburary 18th, the FEDs balance sheet held assets of $3.97 trillion. If they permit another $75 billion to ‘run off’ between now and October, the final balance sheet level will be close to $3.9 trillion. And there it will stay for the foreseeable future. With assets of this quantity, the FED should be able to deliver net annual ‘earnings’ to the U.S. Treasury close to $100 billion per year. This is good … the Treasury can use the money.

Your first take-away here is not that a U.S. recession is imminent. In fact, the FED is now forecasting ‘median’ GDP growth of 2.1% in 2019, 1.9% in 2020, and 1.8% in 2021. So, sure, the FED doesn’t feel our economy as hot as a Ruths’ Chris grill, but it is lukewarm.

The second take-away is this: U.S. interest rates will remain flat. No change. And this condition is likely to persist for 2 years or more. The take-away here is that economies across the globe are slowing a bit. The U.S. is not exempt. Some countries more than others … some, less. But make no mistake: Things are slowing.

I believe I can accurately predict that 2019s GDP growth will be lower than the robust growth numbers we saw in 2018. Ironically, both have the same source of origin: The White House. 2018 growth enjoyed a strong tailwind from the tax cuts and associated actions, boosting total year GDP growth into the high 2s. Conversely, in 2019 countries are facing “trade-war” headwinds, manifesting in the form of increased tariffs, damaged or broken international supply chains, and protectionism.

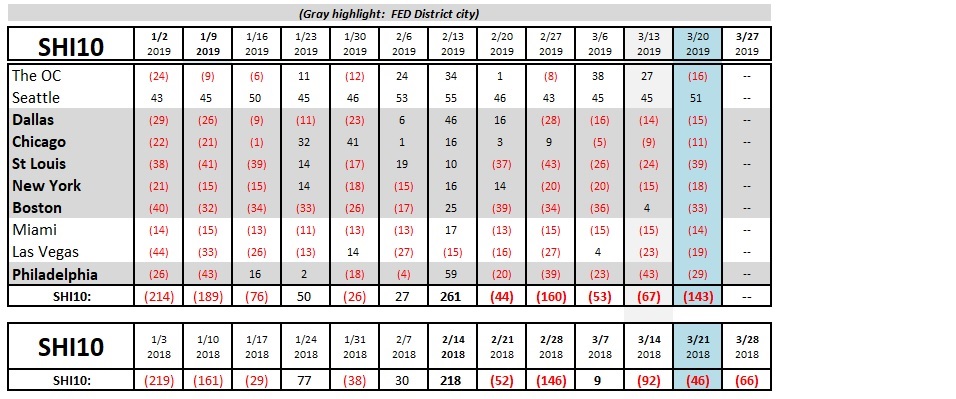

Even the Steak House Index seems to agree with the FEDs summary. Take a look:

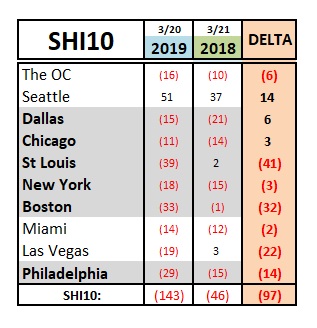

Clearly this week’s SHI10 is very weak — especially when compared to the comparative 2018 figure. I was curious to see how each of the ten (10) SHI markets fared year over year … and prepared this chart:

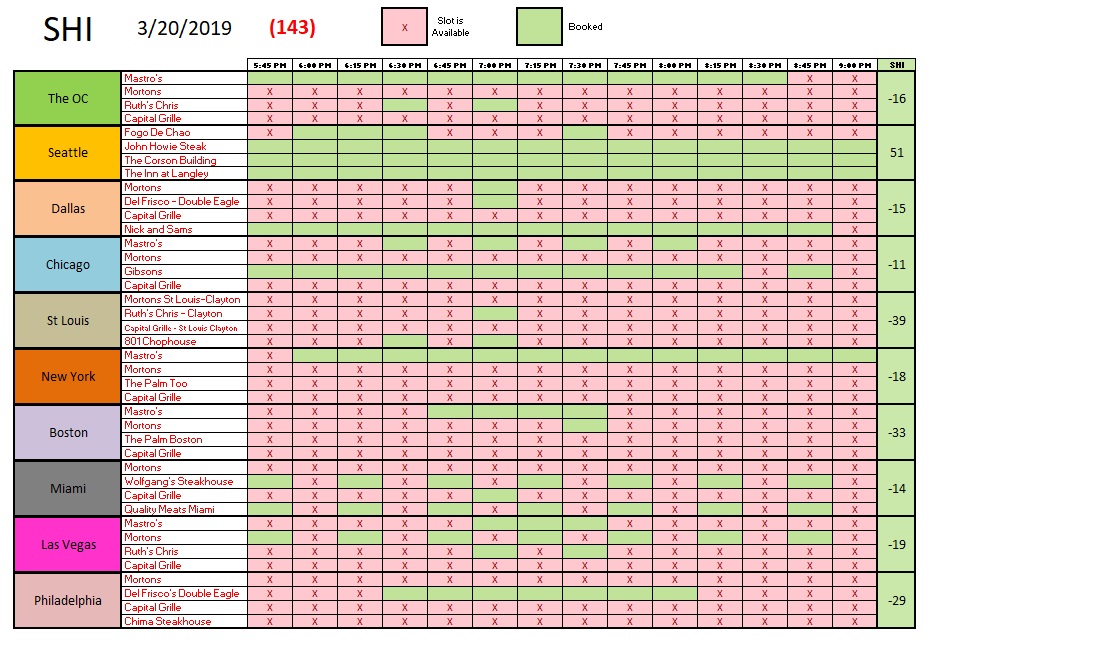

Three of the ten markets saw improvement — Seattle reservation demand has remained robust — but most of the SHI markets reflect a sizable year-over-year reduction in reservation demand at our pricey steakhouses. Here is this week’s chart:

What’s it all mean? Simply this: Consumers may be feeling, or may be worried about, the slowing economy. Let’s see what next week tells us.

But regardless, it’s time for each of us to begin to imagine one, two, or three years of mediocre GDP growth as a best case. Consider how this landscape will impact your business, your investments and your families. Put on those thinking caps. 🙂

- Terry Liebman