SHI 3.14.18 Trump, Tariffs, and Trade

SHI 3.7.18 STEAKONOMICS

March 7, 2018

SHI 3.21.18 FED Day: Following the Script

March 21, 2018

Trump, tariffs, and trade have been all the rage for the past few weeks. Why? Should we care?

Let’s deconstruct the issue. Do trade deficits matter? Trump and his advisor, Peter Navarro, believe the answer is a resounding yes.

My opinion? My answer would also be yes, but not resounding. Yes, long-term trade deficits are probably a bad thing. Notice I said ‘probably?’ The problem with this issue, in my opinion, is two-fold. First, it’s extremely complex. Second, the long-run implications have never been proven or tested. That said, I believe:

- Over the long term, US trade deficits weaken our currency, which, ultimately weakens our standing in the world.

- Over the long term, US trade deficits increase both the size and the cost of our national debt.

- Over the long term, US trade deficits will reduce the aggregate US standard of living, as compared to other developed nations.

Read on and I’ll explain my thoughts.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will continue to be true for years to come.

Is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is almost $80 trillion today.

During the calendar year 2017, US nominal GDP increased by $833 billion … by an amount approximately equal to the market capitalization of Apple. At the end of 2017, US ‘current dollar’ GDP was almost $20 trillion — about 25% of the global total. Other than China — a distant second at around $11 trillion — no other country is close.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released.

Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric.

The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

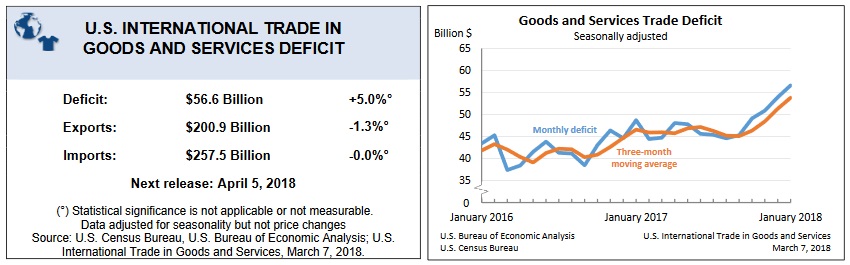

In January, the US exported goods and services valued at $200.9 billion. January imports totaled $257.5 billion. The math is easy, as is the conclusion: We’re importing a LOT more stuff than we’re exporting. A fact easily seen below:

You can see, in the above graph, the trend shows an ever-growing trade deficit. Again, this simply means the US is importing a lot more stuff than we’re exporting.

This is a long, long term trend. The US moved from trade ‘surplus’ to trade ‘deficit’ in 1971 and, with few exceptions, we’ve imported more stuff than we’ve exported every year since. 2006 was the worst year ever: Our deficit exceeded $761 billion that year!

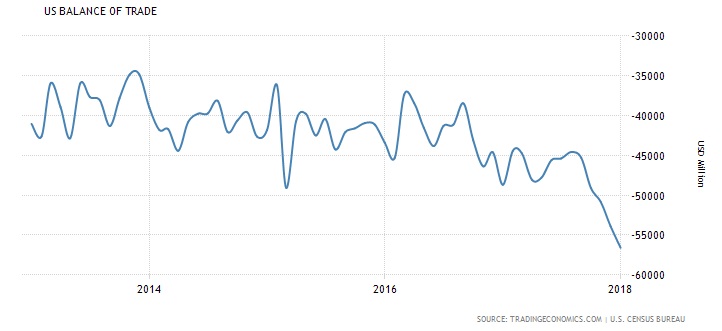

The 5-year chart below shows the same disturbing trend.

As I mentioned above, this is a 5-year chart. What did the 5-years of deficits total? A bit over $2.5 trillion. Hmmm…. that’s a lot of money. (Here’s a chart of all balance of trade statistics since 1960, for you number lovers: https://www.census.gov/foreign-trade/statistics/historical/gands.pdf)

So, again, does it really matter? Yes, it does. Here’s why:

- Currency: The mechanics are fairly simple and easy to follow. When imports exceed exports over a long period of time, our trade deficit accumulates. Said another way, consumers here in the US ‘import‘ stuff and ‘export‘ US dollars. Stuff comes in … dollars go out. In the past 5 years, about $2.5 trillion of those dollars left the US for other countries around the globe. Which means the supply of dollars floating around outside the US is quite large. How large? Even the Bank for International Settlements (BIS) has trouble tracking the number. Back in 2010 it was estimated at about $3 trillion and I’m sure today, given the size of the trade deficit, it exceeds $5 trillion. Where are these dollars? They are held in non-US banks, in dollar denominated accounts, and they are not subject to US banking regulations. The bottom line: The more US currency there is floating “off shore,” the lower it’s value. We’re simply applying the theory of supply and demand, right? I believe this is one of the reasons the US dollar continues to weaken, year after year, against a “basket” of the currencies of our trading partners. In January of 1973, the “Trade Weighted US Dollar Index” was 107. Today, it is 86.

- National Debt: A vendor in, say, China may not want to keep the dollars they received for their exports. They may wish to convert them into yen…which they can do at their local bank. The local bank then takes the US dollars to China’s central bank and also swaps them for yen. China’s central bank can hold the dollars, demand the FED accept the dollars and return yen in exchange, or China can buy US Treasury debt with the dollars. Which they sometimes do. These mechanics are the same in every country we trade with. Thus, some portion of our trade deficit ends up as national debt. Effectively, our current consumption is being financed. The bottom line: Our annual trade deficit increases our national debt. And as our trading partners watch this dynamic year after year, they grow incrementally more concerned about our long-term ability to repay. Which is one of the reasons the German 10-year “bund” is currently trading at 0.6% and the US 10-year Treasury is close to 2.90%. Germany has a large annual trade surplus.

- Standard of Living: This one is pretty simple too. Think about it this way: Right now, Wal-Mart sells inexpensive imported products. A near identical product, if made in the US, would probably cost a lot more. Why? Predominantly, labor. Our incremental manufacturing labor cost is much higher than in China or other less advanced nations. Faced with the choice of, say, a $30 dollar toaster from China and a $50 dollar toaster made here in the US of A, which would the consumer choose? 🙂

Which would you choose?

Theory suggests this “problem” should self-correct. Over time, as the US trade deficit grows larger and larger, our currency value should shrink more and more. Eventually making US exports MUCH cheaper for other countries to buy. And imports EXTREMELY expensive. Theory suggests that when this finally happens, the US would shift from ‘deficit’ to ‘surplus’ and the trend would reverse.

The problem, frankly, is we’ve been “deficit spending” since 1971. The shift hasn’t occurred. The US dollar is so popular, so highly revered, we haven’t seen the value erosion almost every other country would experience under the same conditions.

Thus, the Trump administration is trying to change the paradigm. And artificially speed up the process using tariffs. Will it work? No. But it may result in ALL imports becoming a lot more expensive as our trading partners retaliate with tariffs of their own.

And then, my friends, we will be importing much of the inflation that globalization and trade deficits have held at bay for decades.

Clearly, we’re living beyond our means. And no where is this more obvious than in our pricey steakhouses! Is Lobster Mac & Cheese popular this week? Let’s take a look.

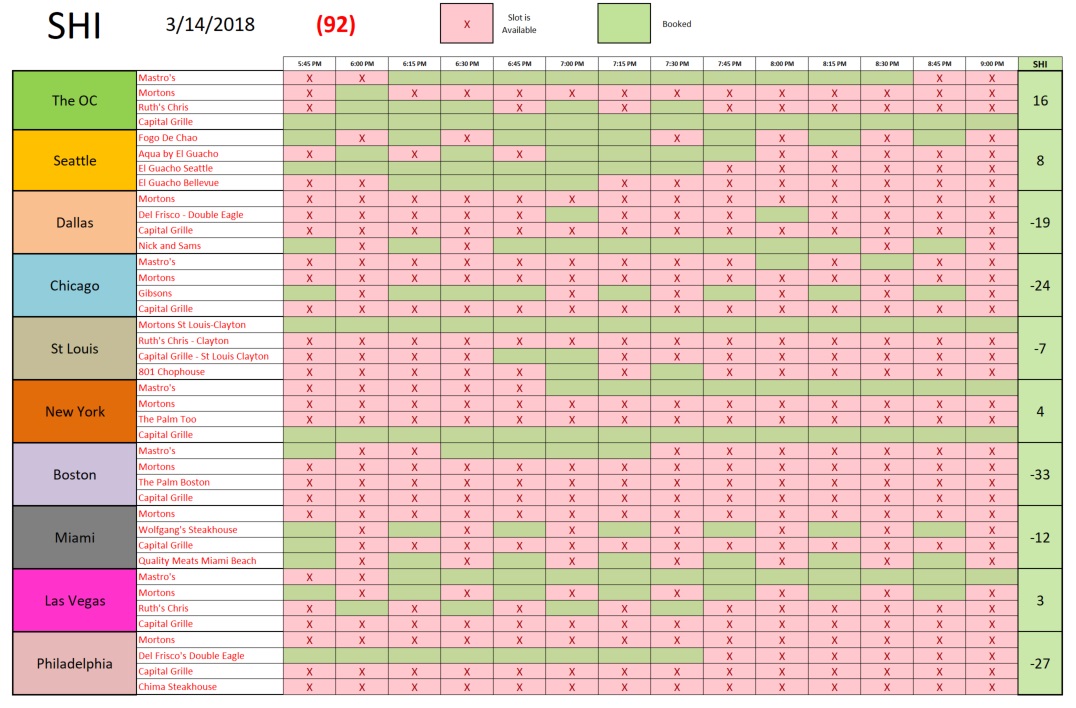

Well, steaks are selling locally, but apparently the “northeasterners” — or whatever they call those horrible storms in the northeast — are taking their toll. Almost no one is heading out for a pricey steak this Saturday in Boston or Philly. But the New Yorkers seem to be braving the weather:

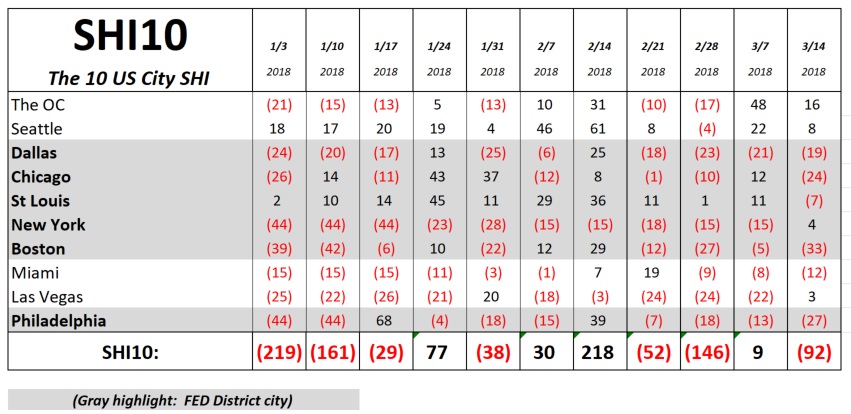

The longer term trend reflects continued economic strength. We’re seeing week-over-week improvement in all west-coast markets. But from Chicago east, both weather and T-Bone consuming conditions seem a bit more challenging:

The SHI10 tells us economy remains strong. The trade deficit is definitely a problem, and we should be seeking solutions. But a trade war is not that solution.

C’est la vie.

– Terry Liebman

2 Comments

Terry,

Thanks for the 3 reasons why it matters. Found that to be a concise and easily digestible way to understand the trade deficits. I will be sharing this specific blog with quite a few people.

Great blog as usual. Thank you.

The idea of taxing imports to reduce the trade deficit makes perfect sense in an ideal world. The problem, as you mentioned, is that things just cost more to make here. This is a result of all the things in place here … regulations, unions, minimum wages, etc. Not judging these, only pointing out that they limit our ability to compete pricewise. This will probably be exacerbated with higher costs for products leading to need for higher wages making product cost more … a vicious cycle. I guess I am saying that resolving this seems hopeless. My real concern is about the debt. This amount is unprecedented in history. If (or probably when) it collapses, the impact is completely unknown. I would really like to see our politicians address the debt!