SHI 11.6.19 – Sputtering Along on 5-Cylinders

SHI 10.30.19 – Today is GDP Day!

October 30, 2019

SHI 11.13.19 King Consumer

November 13, 2019“An 8-cylinder engine can run on only 5.”

At least, this is true according to the internet. And, as we all know, the internet only prints true stuff. 🙂

True or not, that’s what the US economy is doing right now. We’re sputtering along, admirably I might add, on only 5 or 6 cylinders. Two or three are misfiring and adding absolutely no “uumph” to GDP growth. Let me explain.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $85 trillion today. According to the most recent estimate, US ‘current dollar’ GDP now exceeds $21.53 trillion. In Q3 of 2019, nominal GDP grew by 3.5%, following a 4.7% annualized growth rate in Q2. The US still produces about 25% of global GDP. Other than China — in a distant ‘second place’ at around $13 trillion — the GDP of no other country is close. The GDP output of the 28 countries of the European Union collectively approximates US GDP. So, together, the U.S., the EU and China generate about 70% of the global economic output.

The objective of this blog is singular.

It attempts to predict the direction of our GDP ahead of official economic releases. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

GDP growth has slowed recently. Previously, our economic engine was powering on at high speed, firing on all 8 cylinders. Then a few well-intentioned folks gummed up the engine by mixing in too many interest rate increases, an inverted yield curve with incessant talk of the imminent recession, and then <GASP!> a trade war. I say “well-intentioned” because I fully subscribe to the theories underpinning the choices these folks have made. But, like all things in life, timing is everything. Engines are the same: If the timing is off, cylinders misfire, black smoke bellows from the exhaust pipe, and you lose power.

The bigger question we face today is whether or not the misfiring is fatal. Will the loss of a few cylinders cause the engine to seize and spell the end of our economic expansion, or can we head to the shop, get a “tune up,” and keep chugging along?

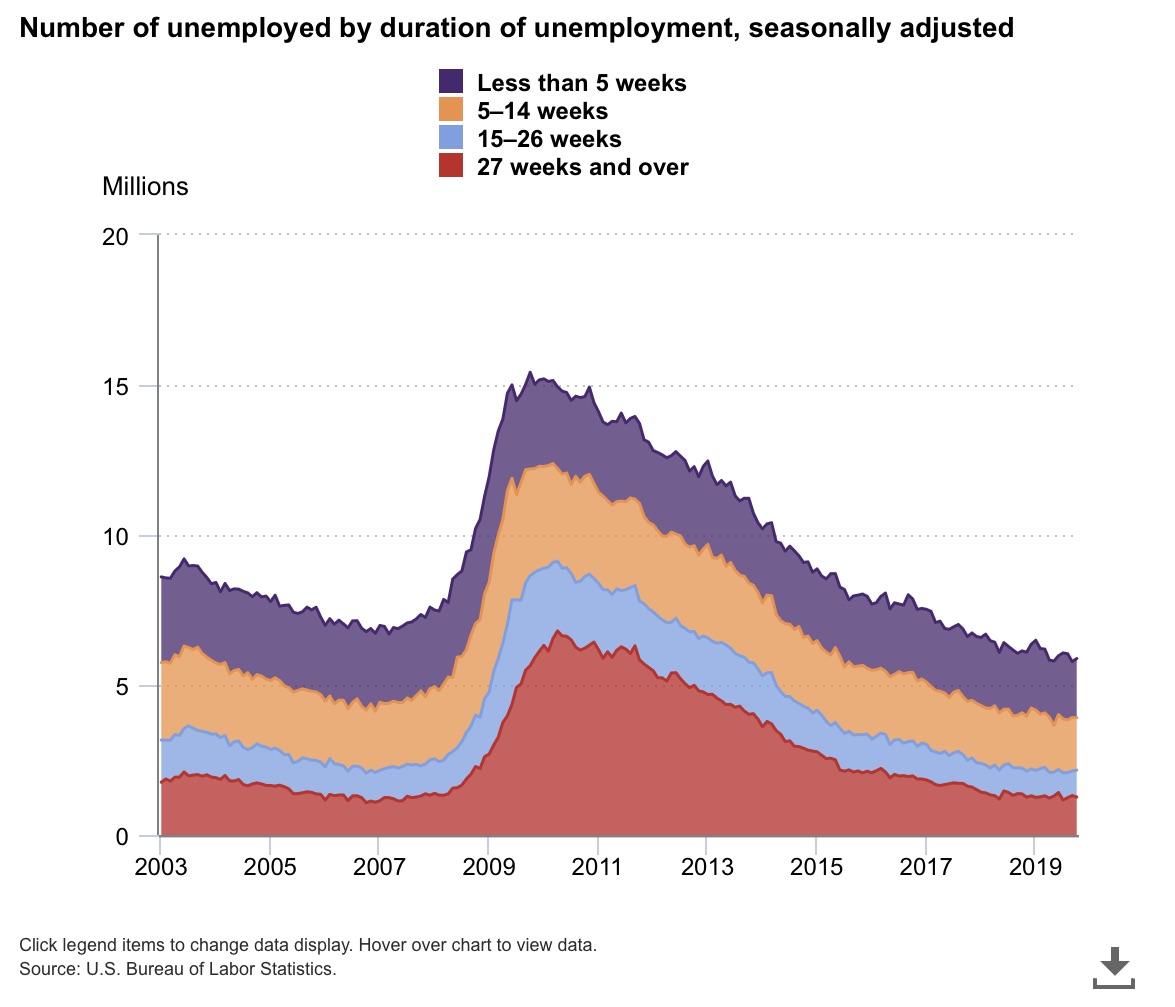

The number of employed folks has never been higher. Right now, 158.5 million people are employed in the US. Out of a total ‘civilian labor force’ of about 164.3 million. Most of those currently unemployed, looking for a job, have not been unemployed for long:

Clearly, this particular cylinder is working quite well! Americans are working!

On the other hand, as I mentioned in my prior blog, the American consumer is showing a bit of fatigue. Sure, people are working, but they are not making much more than they were a year ago. According to the BLS, the ‘average hourly earnings for all employees on private nonfarm payrolls’ have risen by only about 3% in the past year. And remember, this is a ‘nominal’ figure. After adjustment for inflation, the increase is about 1%. That’s not much. And it may be showing in consumer consumption. In September, according the the Commerce Department, imports shrunk quite a bit. Consumer goods, ‘capital’ goods, and automotive vehicles/parts all saw a meaningful decline. Spending may be strained. This cylinder may be misfiring.

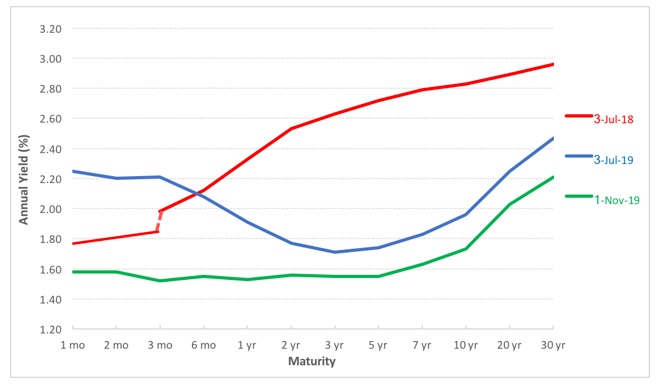

But then we have the new and improved yield curve! Take a look:

The ‘green‘ line — the curve as of November 1st — is nicely positive! Compared to the ‘blue‘ line — from just a few months ago — we see significant improvement. The FEDs choice to lower rates at the short end of the curve (left end) has helped lift the long end of the curve (the right side) up as well … resulting in a curve with nice slope. No inversion here, folks. The FED fixed the inversion. This cylinder is firing just fine!

Corporations continue to struggle, however. According to the most recent BEA data, corporate profits remain flat. Whether this is the result of the tariffs, lackluster productivity, or rising labor costs, after seeing a large boost from the new tax act, current profits are not growing. This cylinder of the engine is sputtering.

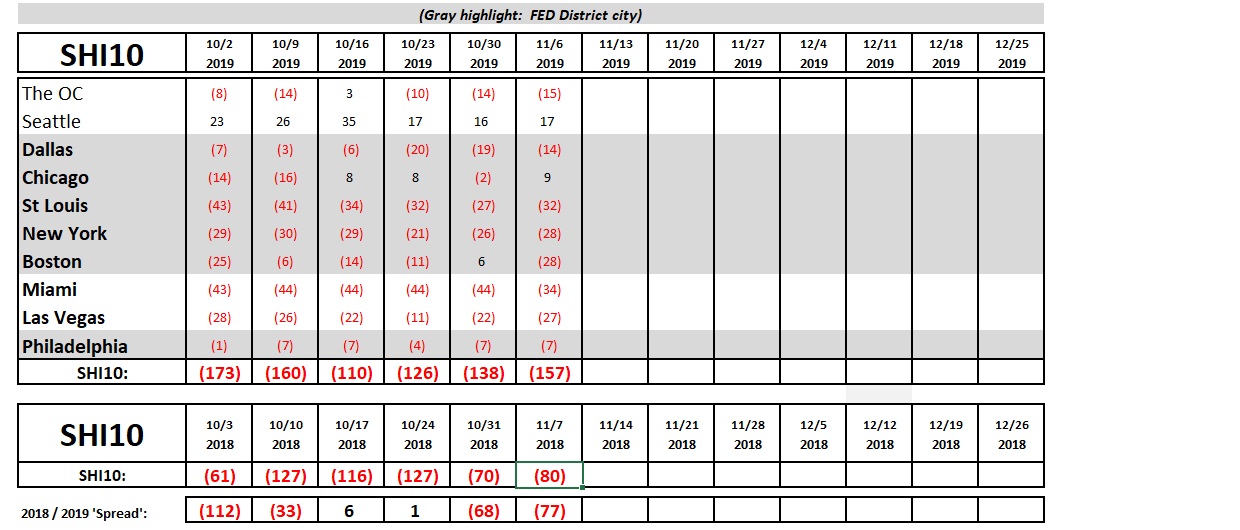

So it’s a mixed bag. Our SHI10 numbers seem to agree. Reservation demand at our pricey eateries is fairly flat too:

With the exception of Boston, most of the cities in our SHI10 index show little change over last week. Once again, activity here appears supportive of an economic engine in need of a tune up.

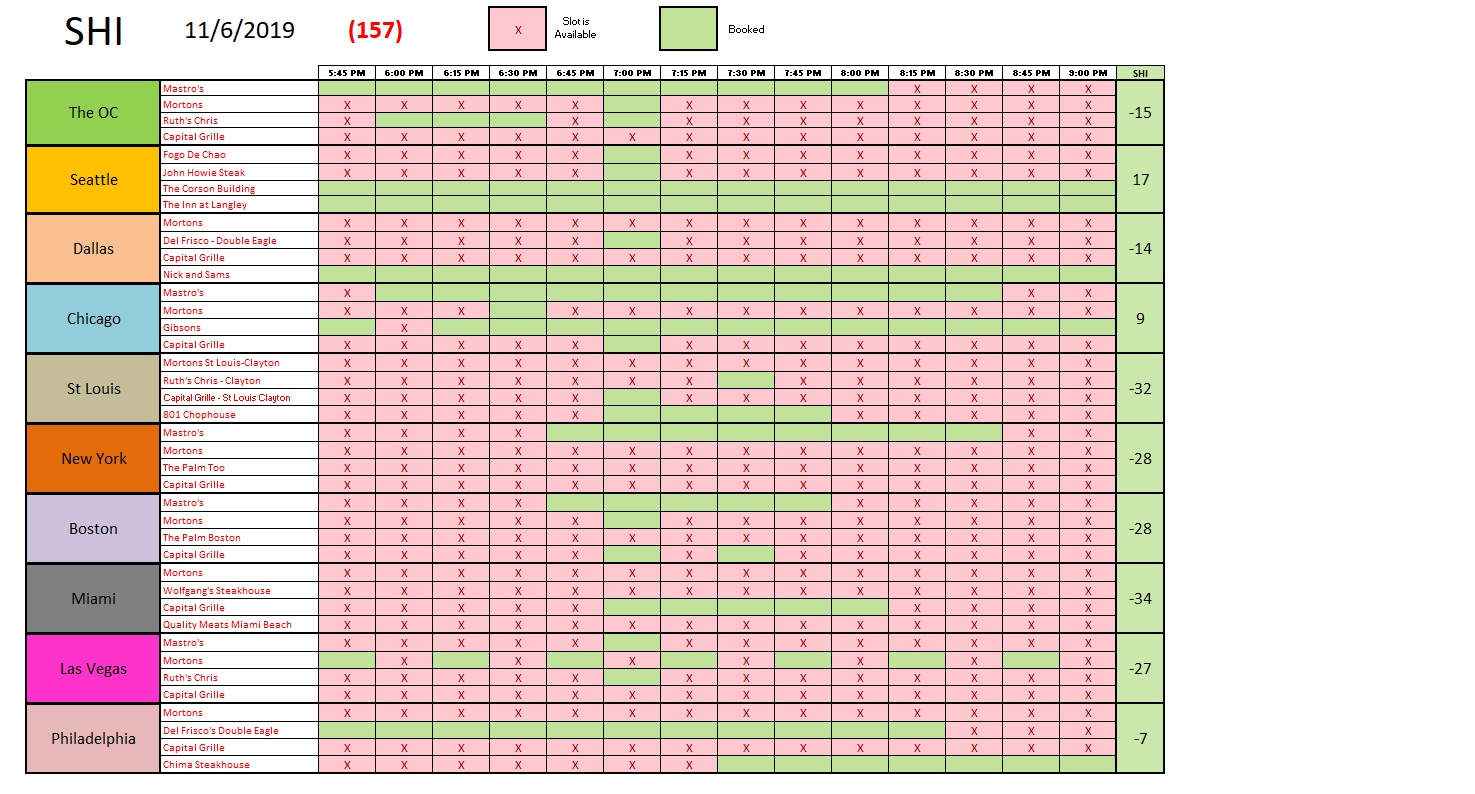

Here’s the weekly chart:

Summary: Notwithstanding the headwinds, the consumer continues to propel the current expansion forward. Consumption levels for both “consumables’ and durable goods remain robust. The economic engine continues to chug along, sputtering and belching smoke, but chugging nonetheless. GDP growth is lower than the recent trend, but the resilience of our economy is impressive. So far. 🙂

– Terry Liebman