SHI 11.27.19 – 400 Years Ago

SHI 11.20.19 A Tasty Visit to The Big Mac Index

November 20, 2019

SHI 12.4.19 – The Issue of Unintended Consequences

December 4, 2019“2020 marks the 400th anniversary of the Plymouth Rock landing.”

400 years. Wow. Depending on who you ask, in the past 400 years the United States has become the greatest country in history, or something vastly different. Just don’t ask a turkey. I can state without equivocation the turkey remains very, very unhappy about this holiday. On the other hand, the cows down on the ranch are in a celebratory mood. 🙂

Much has changed since the pilgrims’ feet first touched the sands. In fact, as I’ve said before, the only thing that never changes is change itself. What gifts will 2020 bring to America and the world at large? It promises to be another fascinating, event-packed year. The Tokyo Olympic games begin on July 24th! Of course, the FED will meet 8 more times next year, hoping to keep America’s expansion going full steam. And in 2020, the “5G experience” will likely hit its stride.

One 2020 prediction I can make with certainty: We will have a presidential election. The outcome? Nope. I won’t make that prediction. I found this entertaining…and you may as well: In a recent edition of The Economist, two different authors in 2 different articles made opposing predictions: One suggested Trump will lose…the other, of course, that he will win. So I will make a prediction of my own: One of these two guys will be right.

2020 is almost here. First and foremost, tomorrow most Americans will enjoy Thanksgiving … celebrating what that holiday means the them. Friends, family and loved ones will gather and enjoy great food, drink, and stories. But don’t get too comfortable: At midnight, ‘Black Friday’ will have arrived and the SHOPPING BEGINS! 2020 may bring many changes, but this won’t be one of them.

What might change in 2020? Let the 2020 predictions begin!

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $85 trillion today. According to the most recent estimate, US ‘current dollar’ GDP now exceeds $21.53 trillion. In Q3 of 2019, nominal GDP grew by 3.5%, following a 4.7% annualized growth rate in Q2. The US still produces about 25% of global GDP. Other than China — in a distant ‘second place’ at around $13 trillion — the GDP of no other country is close. The GDP output of the 28 countries of the European Union collectively approximates US GDP. So, together, the U.S., the EU and China generate about 70% of the global economic output.

The objective of this blog is singular.

It attempts to predict the direction of our GDP ahead of official economic releases. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

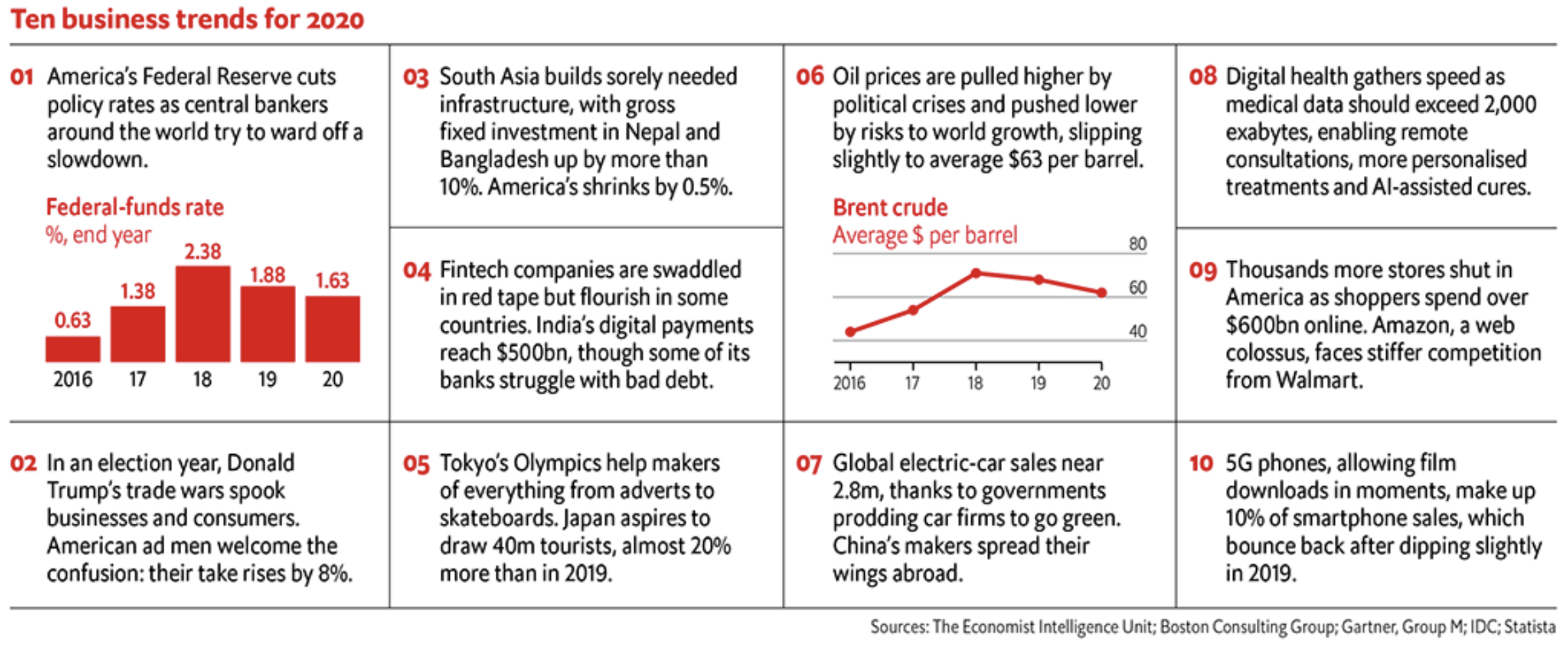

Let’s start here. The Economist magazine gave us these ten business predictions for 2020:

Number one, it seems, is their expectation for another 25 basis point FED rate cut. I don’t agree. I think the FED will hold pat during 2020. Make no mistake, I remain convinced that Q4 GDP growth will be dismal. And this dismal performance is likely to repeat in Q1, 2020, but absent a negative GDP reading, indicating a contraction may be starting, I think the FED will leave rates unchanged. Because, at present, I do not yet believe the GDP will go negative in 2020. I believe it may get very close to zero … but growth will remain positive. My opinion is dynamic however, and can change based on the evolving landscape. You’ll be the first to know if it does.

Notice the predictions, in #5, #7 and #9, concerning opposing forces. Oil and the electric car. Retail stores and and on-line shopping. The rise of one can only occur at the expense of the other. A zero sum game. How important will oil be as an energy source 30-year hence? In 2050? There’s a great topic for a book. But we don’t need a book to help us understand the future of the shopping mall. Make no mistake, it will survive. But not in its current form … nor in its current size. The easiest fix: Convert functionally obsolete shopping centers into distribution centers for on-line shopping companies like Amazon and (coming soon) Kroger. Regardless, here’s another of my predictions: The disruption in retail will prove challenging and ugly for both real estate investors and REIT investors. That said, in the coming years there may be phenomenal opportunity for sharp and creative investors in this space who are able to navigate the bear-traps.

Regardless of the individual winners and losers within the US economy, one forecast is a lock: From an economic viewpoint, the next 30 years will be far different than the last. The structural underpinnings of the economy will be very different in 2020 than in 1990.

Our population growth rate most recently peaked in 1992 at almost 1.4% per year. This rate has whittled away each year, now just over 0.6% in 2018. In spite of this headwind, the US ‘Civilian Labor Force’ has been able to maintain about a 1% annual growth rate since 2015, as the employment picture brightened and more folks decided to join the labor force. But this trend will slow too, in the years to come … as the pool of potential workers reaches to the lowest level the US has ever seen, on a percentage basis.

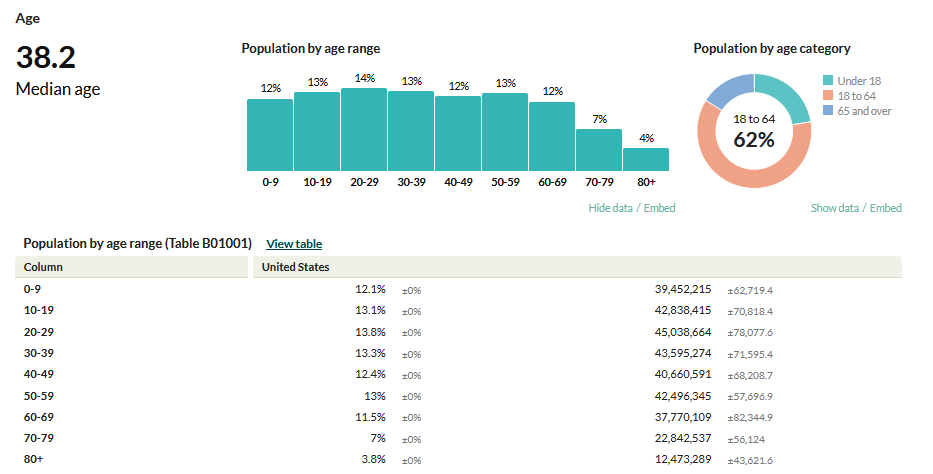

And in 2020 the “age thing” reaches a new pinnacle: A large majority of the 77 million ‘boomers’ will hit 65 years of age. According to the US Census, in 2018 our country had reached a population of 327 million people with a median age of 38.2 years. As you can see in the chart below, there are a lot more folks over 30 than under:

The bottom line: In the coming years, the US economy won’t have the ‘horsepower’ to replicate the big GDP growth years of the 1990s. Even at full capacity. Of course, the one wild card is technology, and its potential impact on labor productivity. But absent any meaningful improvement here, the best years of US GDP growth are probably behind us.

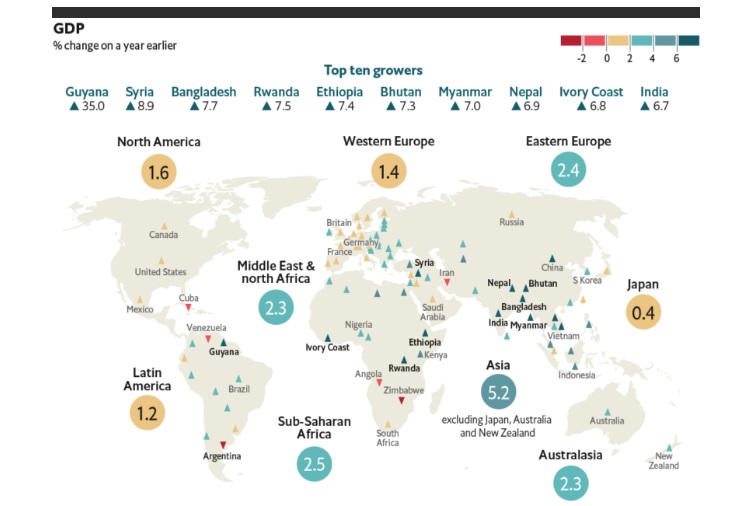

That doesn’t mean we cannot — or won’t — have a thriving economy. We can and I believe we will. But future GDP growth readings will be hard-pressed to exceed 2%. My opinion. There are many differing views on this topic, but since the level of GDP growth is a function of two inputs — US labor and productivity — without meaningful growth in the inputs, I simply do not have high hopes for annual, sustained GDP growth exceeding 2% to 2.2%. But here in the ‘western world’ with aging populations, 2% is a respectable achievement. In fact, The Economist magazine doesn’t believe Japan’s 2020 GDP growth will be much above zero. Here are their predictions for the world in 2020:

The difference between ‘Asia’ and ‘Japan’ is staggering. But without the ‘horsepower’ (a growing labor force or increased labor productivity) needed to amplify growth, an economy simply cannot do it.

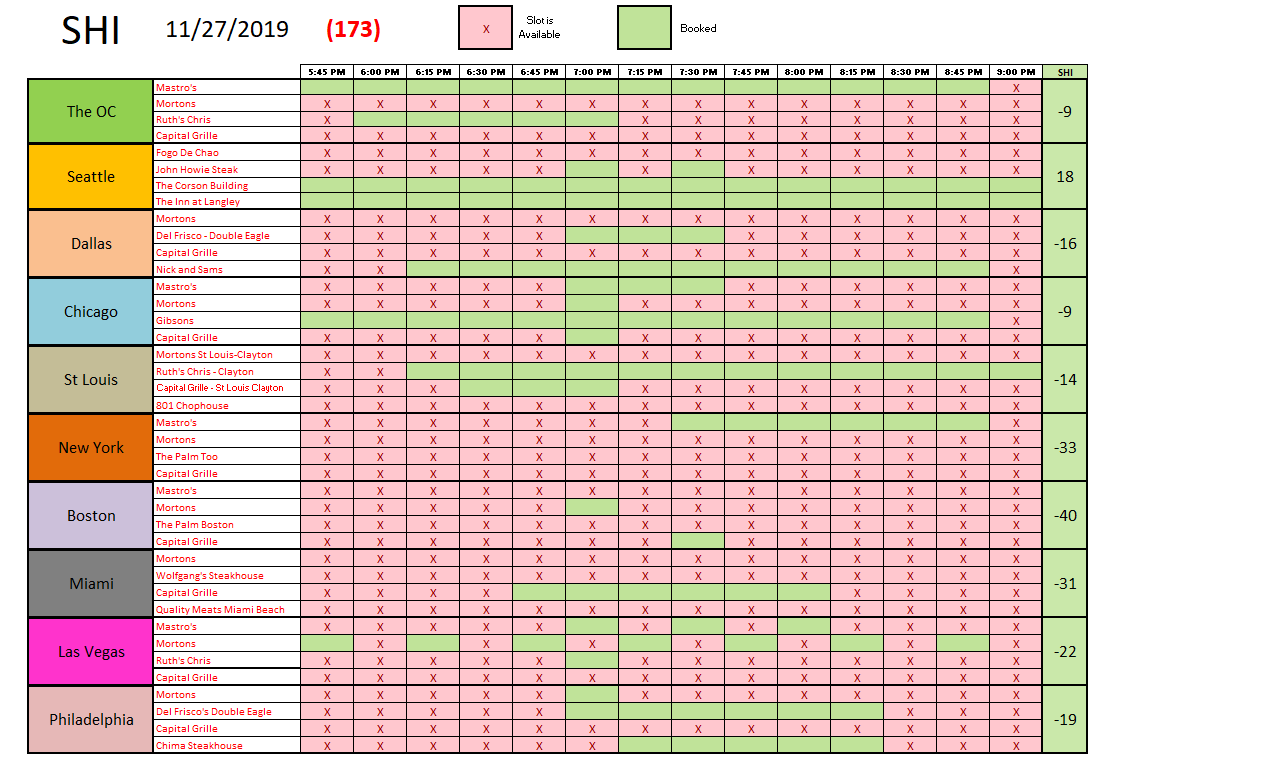

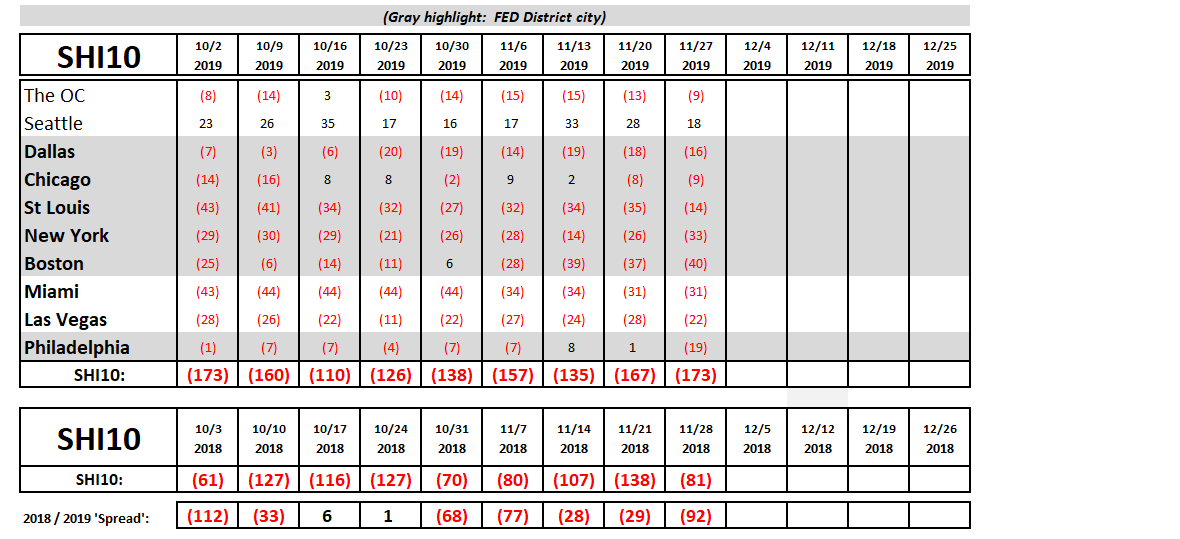

Let’s check in on this weeks SHI. Hmmm …. this is not a great week for our purveyors of expensive cuts of beef:

And here’s the trend chart. Again we can see that with an SHI10 reading of negative <173> there are plenty of reservations available at your favorite steakhouse this weekend. Once again, with the exception of Mastros Ocean Club.

I hope you have a very enjoyable Thanksgiving holiday.

- Terry Liebman