SHI 10.23.19 – Watching A Rare Grilling

SHI 10.16.19 – The FED Loads up on T-Bills

October 16, 2019

SHI 10.30.19 – Today is GDP Day!

October 30, 2019“At the proper grill temp, it takes only minutes to cook a rare steak.”

I suspect Mark Zuckerberg was feeling the heat — and wishing the temperature was right — when he testified earlier today at Congress. Because his grilling took a lot longer than a few minutes. He was pretty much charred and burnt to a crisp by the time he left. The only thing rare about his grilling was the appearance itself. Congress, in all their glory, worked hard to ensure any future appearances by Mark will be rare indeed.

Why was Mark on the grill? Ostensibly to discuss Libra — Facebook’s digital currency. And this is where this week’s tale begins.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $85 trillion today. US ‘current dollar’ GDP now exceeds $21.3 trillion. In Q2 of 2019, nominal GDP grew by 4.7%. The US still produces about 25% of global GDP. Other than China — in a distant ‘second place’ at around $13 trillion — the GDP of no other country is close. The GDP output of the 28 countries of the European Union collectively approximates US GDP. So, together, the U.S., the EU and China generate about 70% of the global economic output.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases.

Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

What is Libra? It is a digital currency. According to a recent article in The Economist:

“If all goes according to plan, Libra will be bought, sold, held, sent and received within the firm’s apps, Messenger and WhatsApp, and also rival ones. A tap on a smartphone will make money change hands almost instantaneously, even if sender and receiver are on different sides of the planet.

Libra is, in effect, an attempt to undercut existing payment services by re-inventing and improving bitcoin ten years after its launch. Whereas bitcoin transactions may take minutes to confirm and can cost several dollars, Libra should move within seconds for negligible fees. Whereas bitcoin’s price is extremely volatile, Libra’s swings should be minimal as it will be backed by a basket of currencies. And whereas a transaction using bitcoin needs more than 1,000 kWh of computing energy, Libra transactions should consume no more energy than credit-card ones.”

Wow. Imaging the ability to move money instantaneously, anywhere in the world, at a negligible cost, and without much energy consumption. Double-wow.

Can you imagine how cool this would be? Well, I don’t think any government or central bank will share your joy. In fact, I suspect they are very worried. Perhaps a bit less, say, than their concerns about bitcoin. This might be because unlike bitcoin, Libra’s design requires that an actual “real” currency — dollars, yen, bhat, ducat, etc. — is used to buy its equivalent value of Libra. And since the Libra in circulation will be backed by actual currency, local regulators — in theory — will have the ability to keep tabs on it.

But here’s where the regulator’s comfort probably ends. Because in reality, the debate here is not about functionality or management, it’s about size. According to statista.com, in Q2 of this year, Facebook had 2.41 billion active monthly users. Holy canoles! I’ll say it again: 2.41 BILLION folks use Facebook every single month! The globe has a population of about 7.5 billion folks. The math here is pretty easy.

One out of three people on the planet use Facebook every month.

Now consider this: According to worldatlas.com, we have about $90 trillion of currencies floating around the globe. From all 190 countries combined. Now imagine if only 10% of that amount was ‘converted’ into Libra over a 10 year period. In this hypothetical instance, Libra would have about $9 trillion in circulation. Triple-wow.

What could possibly go wrong? 🙂

I don’t even know where to start. Currencies have been around for about 10,000 years. Interesting enough, according to A History of the World in 6 Glasses, the first currency was actually beer. Yes, beer. At around 8000 BC, the “seeds were sown” by beer for accountancy, writing and bureaucracy. Later, wine became another de facto currency. But that’s another story.

Fast forward to today, 10,000 years later, currencies have evolved into a government-sponsored, closely monitored framework, spanning the globe. And, as you know, the preeminent currency is the US dollar. According to the International Monetary Fund (IMF), in the first quarter of 2019, the US dollar made up 61% of all known central bank foreign exchange reserves. Wow again.

Clearly, the US dollar is the de facto currency of the world today. What might happen to (1) the value of the US dollar and (2) the US economy as a whole should Libra challenge the hegemony of the US dollar?

This is a forward-looking, economics blog. In this evolving age of digitization, automation, robotics, AI, and the list goes on, we have to consider the implications a digital currency such as Libra might have on our economy. Because I don’t think we can even imagine what might go wrong. Don’t get me wrong: I’m not against digital currencies. Not at all. I am simply concerned about the potential implications. But there is one thing I know for certain: It’s coming. With a market capitalization of $1/2 trillion and monthly users amounting to 1/3 of the globe’s population, Facebook has the financial strength and distribution network to launch this thing. You and I know it. And Congress knows it. Which is why Mr. Zuckerberg showed up today for his grilling. As painful as it must have been for him, at least he showed up. And I got the feeling he recognizes this thing for the monster that it is. And could become.

The future is coming fast. Buckle up. Let’s grab a steak.

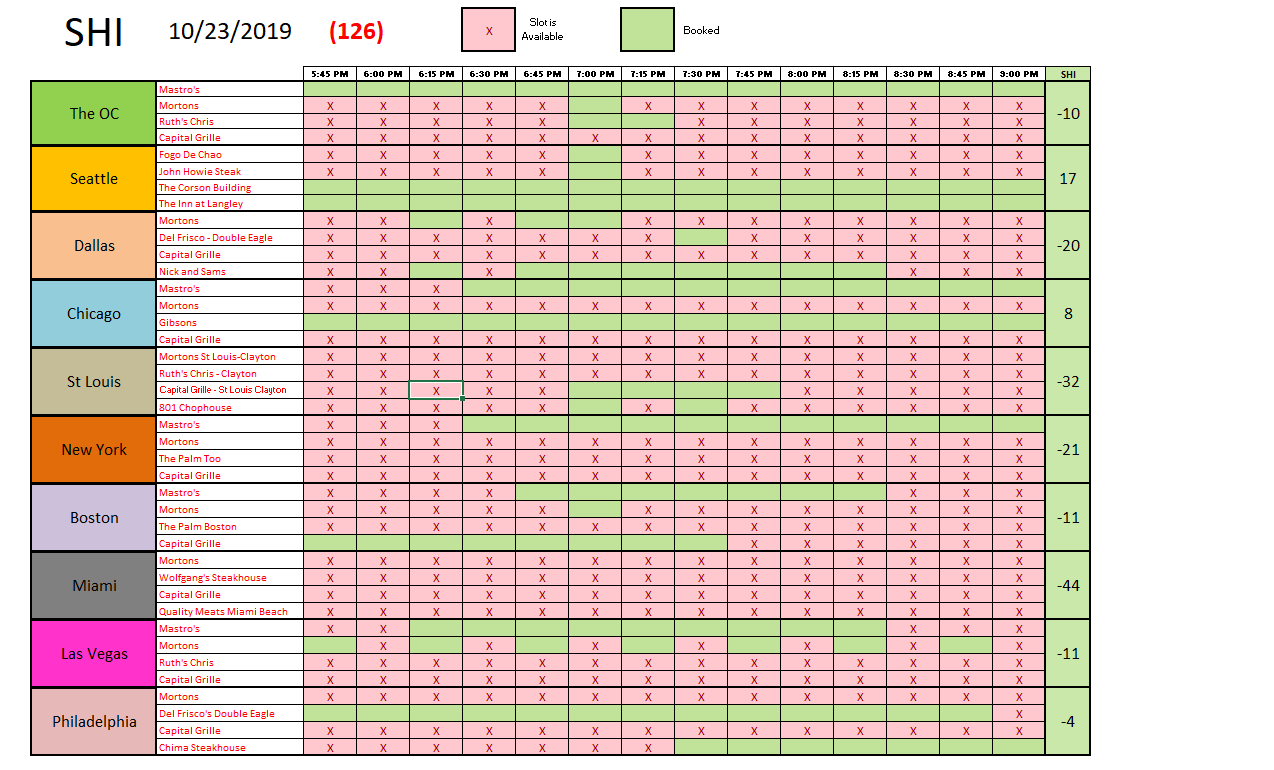

Other than Miami, where expensive slabs of beef remain in the dog-house, reservation demand in most of our SHI10 cities is fairly strong. The only word we can use for Miami is consistent. 🙂

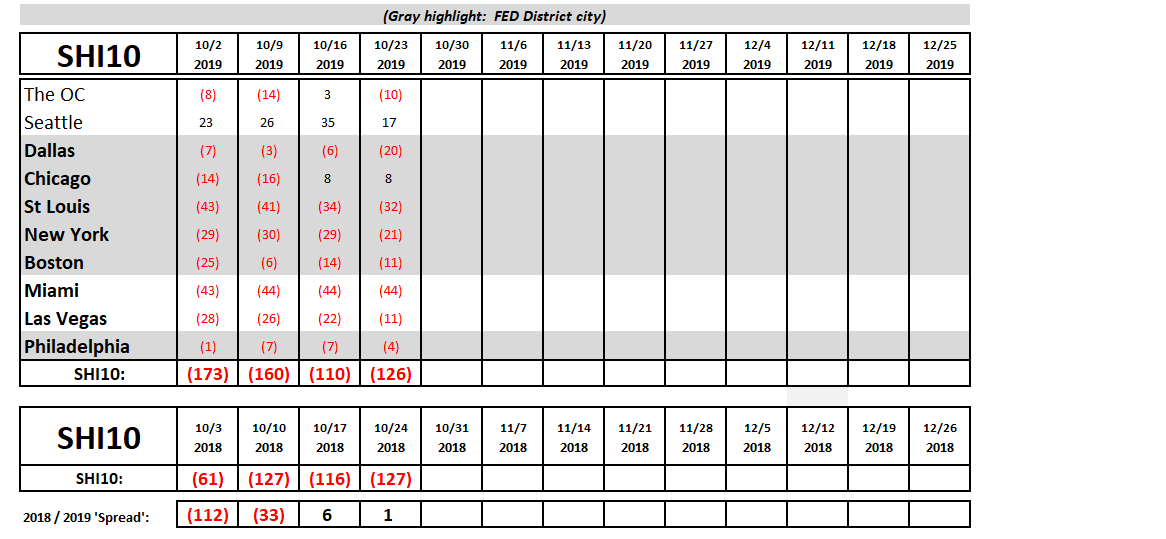

It’s worth noting that many of the cities we track have numerous steakhouses for hungry patrons to select from. For example, reservation demand in NYC consistently looks lukewarm at best. But the search for a table at one of Manhattan’s exclusive eateries — where you can expect to spend about 100 bucks per diner — reveals more than 80 competing steakhouse restaurants. So finding a fully-booked time slot may be more rare than an open table. Here’s the longer-term trend chart:

Interesting. This week our SHI10 is 1 point better than about a year ago. Consumer consumption of costly cuts of beef remains robust. In the face of all the headwinds, this is a good sign for the economy. No, my concerns for our economy are not diminished; but, it’s nice to see our steakhouses within the SHI10 are suggesting our consumer remains frisky and willing to part with his or her hard earned dollars, yen, bhat, and ducats. And soon, perhaps Libra will join the list. 🙂

– Terry Liebman