SHI 10.17.18 That’s Quite a JOLT!

SHI 10.10.18 The Investor vs. the Consumer

October 10, 2018

SHI 10.24.18 Give and Take

October 24, 2018

“Never touch the plate at Ruths’ Chris.”

It’s hot. Really hot. In fact,they’ll tell you your steak was grilled at 1200 degrees…and served on a plate heated to 500. That’s hot. You’ll get quite a jolt.

The stock markets got one on Tuesday. But their jolt came from the “Job Openings and Labor Turnover” Survey released by the Bureau of Labor Statistics. Known as JOLTS, it seems to have electrified the markets, sending the DOW up almost 550 points in one day. That’s quite a change from one week ago, when stocks were dropping like a stone. What the heck is going on with our economy?

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will continue to be true for years to come.

Is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.4 trillion. In Q2 of 2018, We remain about 25% of global GDP. Other than China — a distant second at around $11 trillion — the GDP of no other country is close.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

Volatility. Insecurity. Lack of certainty. Unpredictable. These words and phrases describe the mood many investors seem to be feeling these days. And for good reason: There’s plenty to be nervous about.

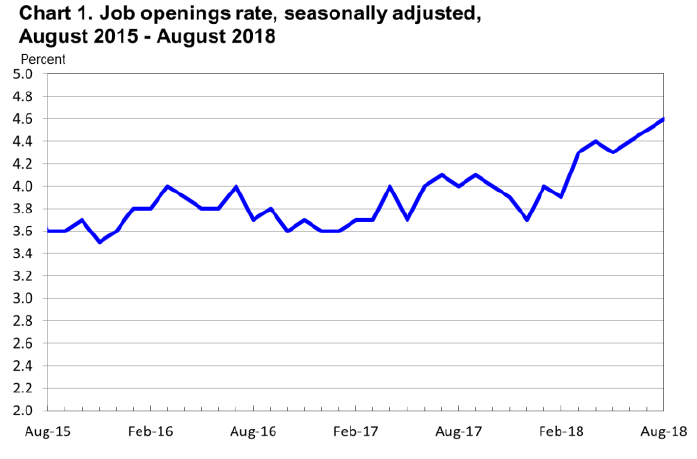

Interestingly enough, the JOLT survey isn’t one of them. The survey, which measures the number of jobs employers are looking to fill in the very near future, shows employers need over 7.1 million new employees — the highest reading ever. One year ago, at the end of August, 2017, that number was about 5.5 million. That’s quite an increase. This graph shows the story quite well:

Look at that upward trajectory. Clearly, there are plenty of jobs out there. Unfilled. Ready for qualified employees.

Which ‘industry‘ experienced one of the largest percentage increase in unfilled jobs? Construction. In one year, unfilled jobs increased almost 39%.

Between August of 2017 and August of 2018, about 1.8 million people joined the labor force. This notwithstanding, there are still plenty of jobs seeking workers who are qualified.

Permit me a quick comment on the issue of “qualified” and then I’ll move on: In the last BLS labor survey, we see the September 2018 unemployment number fell to 3.7% — a very, very low number. But the “Teenager” (16-19) unemployment rate is 12.8%. And the rate for “Less than a high school diploma”? 5.5%. Apparently kids attending high school, and adults who didn’t finish high school, share the same affliction: They are simply harder to employ.

But the JOLTS report confirms one thing: People are working…and there are plenty of jobs available for anyone who is not. Both of which mean the economy is cooking! Let’s see if pricey steaks are doing the same this week. Yep! Steaks are hot, too!

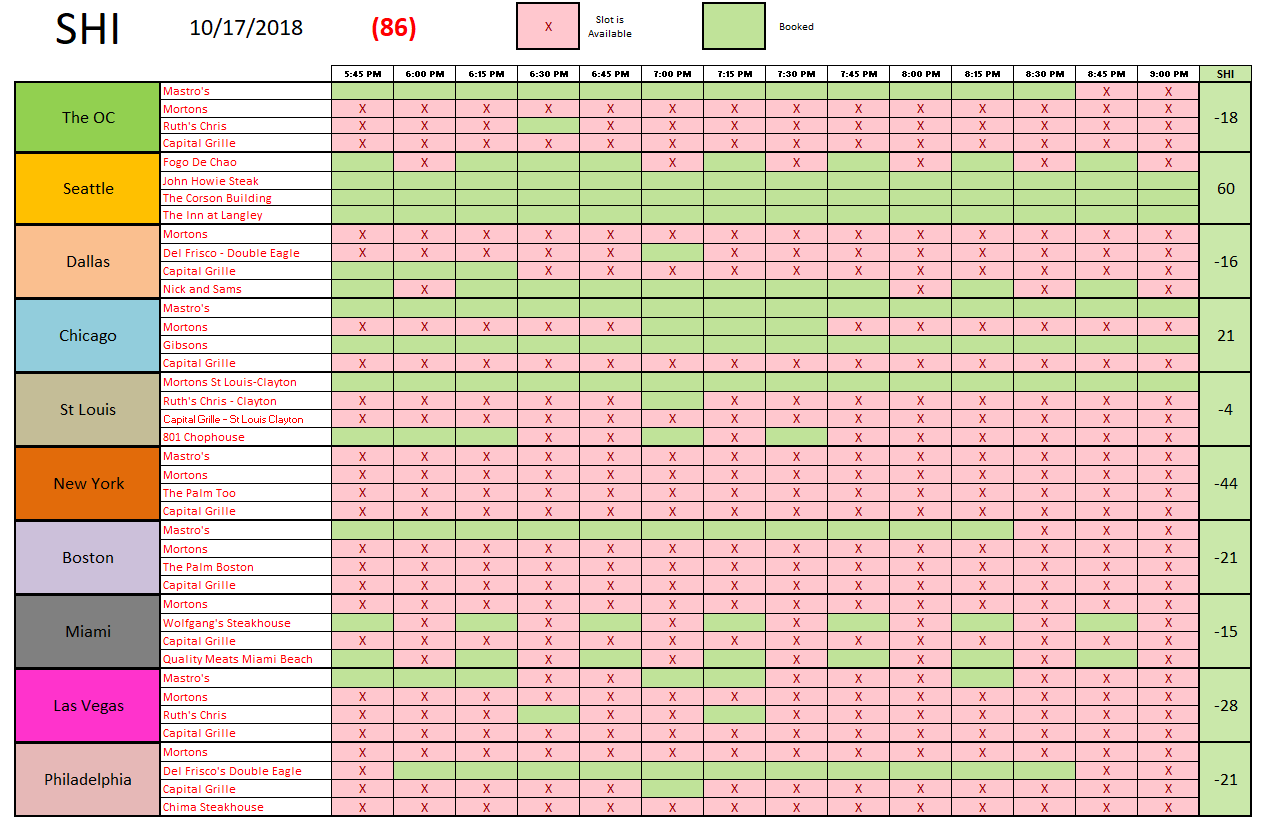

Maybe not as molten hot as the JOLT survey…but hot nonetheless. It’s interesting to note that improvement in the Chicago SHI is offset by reservation weakness in NYC. As I’ve said before, I sure wouldn’t want to own a steakhouse in NYC. Too many good options.

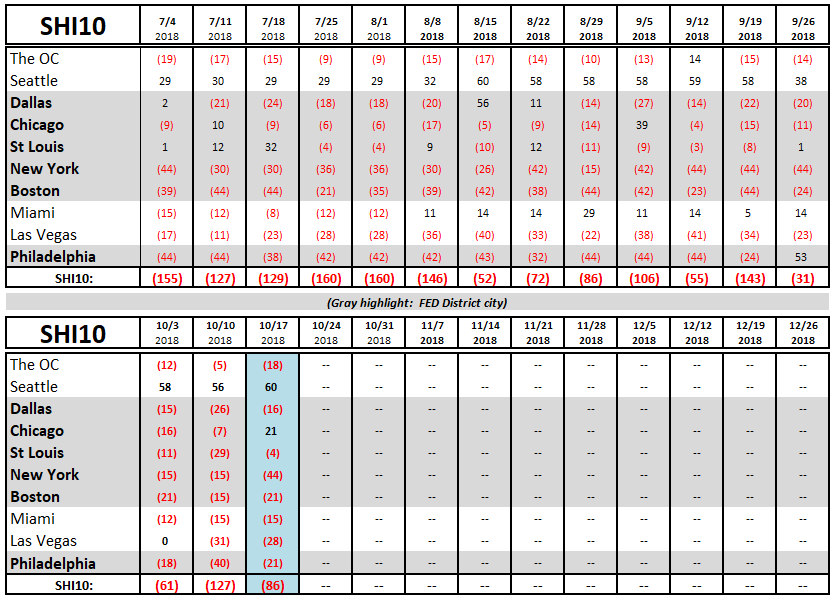

Here is the detailed SHI for each of our 10 cities:

It’s easy to understand why the FED want’s to raise rates. I get it. I only hope they don’t raise them too far … to fast. Nothing kills an expansion faster. But for now, the US economy — and pricey steaks — are smoking hot!

– Terry Liebman