SHI 10.16.19 – The FED Loads up on T-Bills

SHI 10.9.19 – Cracks in the Foundation

October 9, 2019

SHI 10.23.19 – Watching A Rare Grilling

October 23, 2019“The FED balance sheet is growing again.”

No, this time the FED is not buying Treasury instruments to stimulate the economy. Instead of buying ‘long-term’ duration Treasury instruments, they are buying the ‘short-term’ Treasury bills. A Treasury bill is defined as a Treasury security with a maturity of 1 year or less. Why is the FED buying bills … and why are they growing the balance sheet once again?

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will be true for years to come.

But is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $85 trillion today. US ‘current dollar’ GDP now exceeds $21.3 trillion. In Q2 of 2019, nominal GDP grew by 4.7%. The US still produces about 25% of global GDP. Other than China — in a distant ‘second place’ at around $13 trillion — the GDP of no other country is close. The GDP output of the 28 countries of the European Union collectively approximates US GDP. So, together, the U.S., the EU and China generate about 70% of the global economic output.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases.

Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

During the lengthy FED ‘quantitative easing,’ the FEDs balance sheet grew to about $4.5 trillion. Then, believing US economic growth was picking up steam, they made the decision to shrink the balance sheet. Reducing the balance sheet extracts money (liquidity) out of the financial system. This process, the opposite of ‘quantitative easing‘, is one of the FEDs tools intending to lift interest rates. They permitted their assets to slip down to about $3.8 trillion.

I wasn’t a fan of the move … but, hey, the FED rarely calls me for advice.

They should have. Because in their haste to tighten monetary policy, they inadvertently squeezed systemic liquidity below a level that has become problematic. On October 11th, they reversed their stance, permitting the balance sheet to grow again. Here is an excerpt from their published statement:

“The (FED) Desk plans to purchase Treasury bills at an initial pace of approximately $60 billion per month, starting with the period from mid-October to mid-November. These reserve management purchases of Treasury bills will be in addition to the Desk’s ongoing purchases of Treasury securities related to the reinvestment of principal payments from the Federal Reserve’s holdings of agency debt and agency mortgage-backed securities.”

At this pace, the balance sheet will grow by almost 3/4 of a trillion dollars in the next year. Good.

You may recall a blog I wrote more than two years ago on the size of the FED balance sheet. To quote myself, “Further, the FEDs assets today must remain at or near $3.5 trillion. US currency needs and excess reserve deposits make this level mandatory.”

While my lower level was, well, too low, I was spot-on conceptually. And that’s precisely the problem today: Banking reserves have become perilously thin. So this move by the FED is a good change. If you want to re-read my original post, here’s a link:

https://www.steakhouseindex.com/the-feds-trillion-dollar-balance-sheet/

I’m pleased the FED is solving the reserve problem. But I’m more excited about the financial benefit to the US Treasury. Here’s why. Back in January of 2019, the FED posted this comment:

“The Federal Reserve Board on Thursday announced preliminary results indicating that the Reserve Banks provided for payments of approximately $65.4 billion of their estimated 2018 net income to the U.S. Treasury. The net income of $63.1 billion represents a decrease of $17.6 billion from 2017, primarily attributable to an increase of $12.6 billion in interest expense associated with reserve balances held by depository institutions. Net income for 2018 was derived primarily from $112.3 billion in interest income on securities. The Federal Reserve Banks had interest expense of $38.5 billion primarily associated with reserve balances held by depository institutions.

Cutting thru the gristle, right to the meat of the matter, the bottom line is the FED paid the US Treasury about $65 billion in 2018. A year when the balance sheet was shrinking. Now that it’s growing again, I expect FED payments to the Treasury to increase.

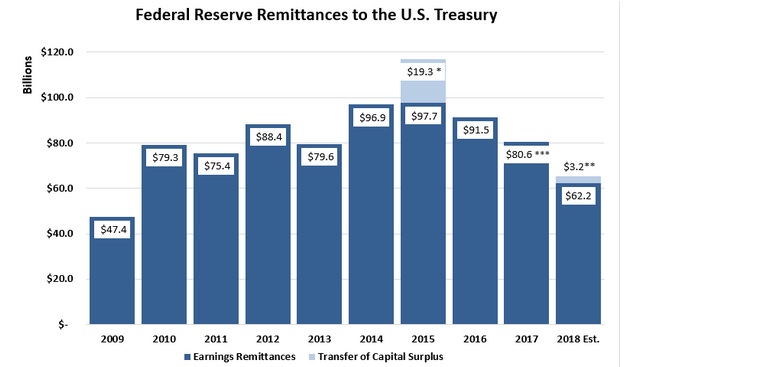

Believe me: This is a good thing. With the Treasury’s current $1 trillion ‘plus’ annual deficit, it can use all the income it can get. The bigger the balance sheet, the bigger the payment from the FED to the Treasury. These annual payments can be quite large. The chart below shows the historic payments from the FED to the Treasury.

Yes, during 2014 and 2015, the FED paid the US Treasury almost $100 billion.

The larger the FED balance sheet, the more they will earn, and the more they will remit to the Treasury. And, of course, the banking stresses caused by marginal liquidity is also reduced. It’s a win-win! 🙂

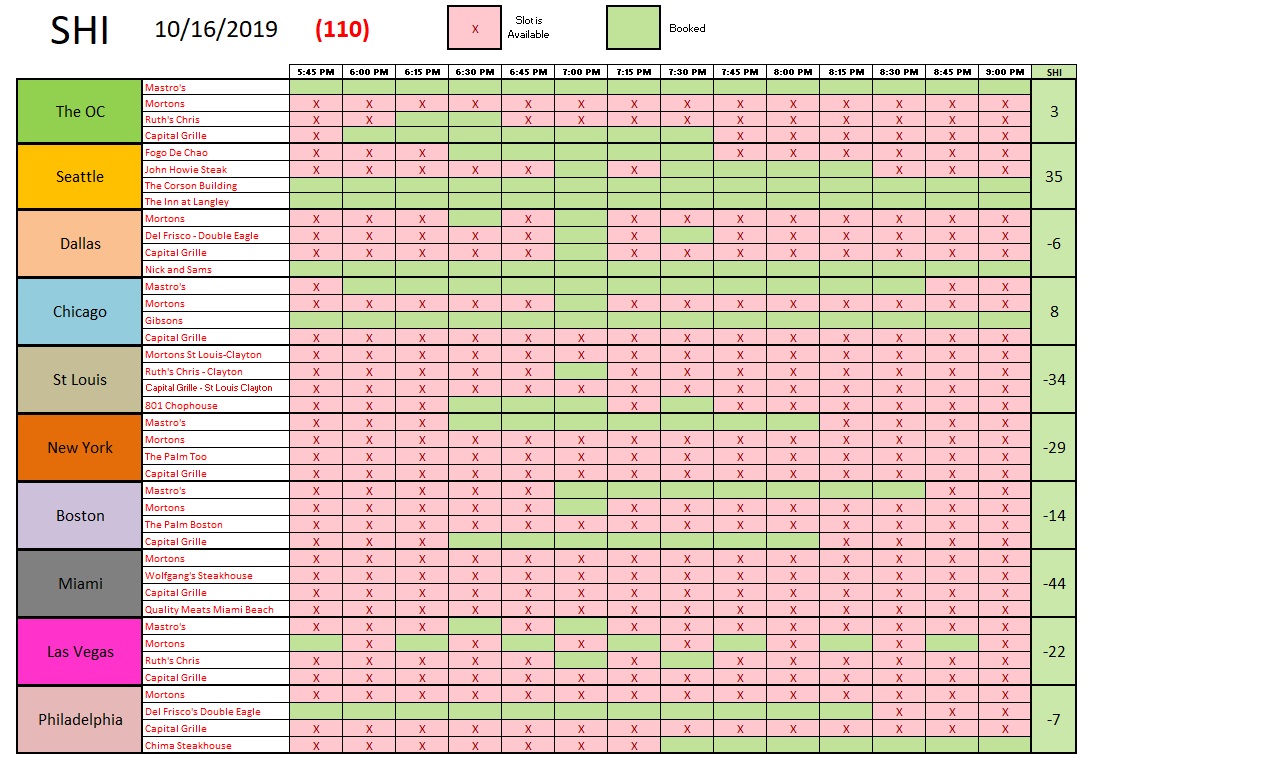

Let’s add a smoking-hot Rib-eye to the mix and we will have a win-win-win! Here is this week’s SHI10:

It looks like Americans are loading up on expensive steaks! While an SHI10 reading of negative <110> is far from sizzling, it indicates a reasonable level of pricey restaurant reservation demand. Just about every city in the index is showing ‘booked’ time-slots. Miami, unfortunately, is not. Clearly Miami’s population are not red-meat fans. Demand for fancy steaks is about the same as the center-temperature of a rare steak: Cool. Very cool. My advice to anyone thinking about opening a steak-house in Miami? DON’T. Bad choice.

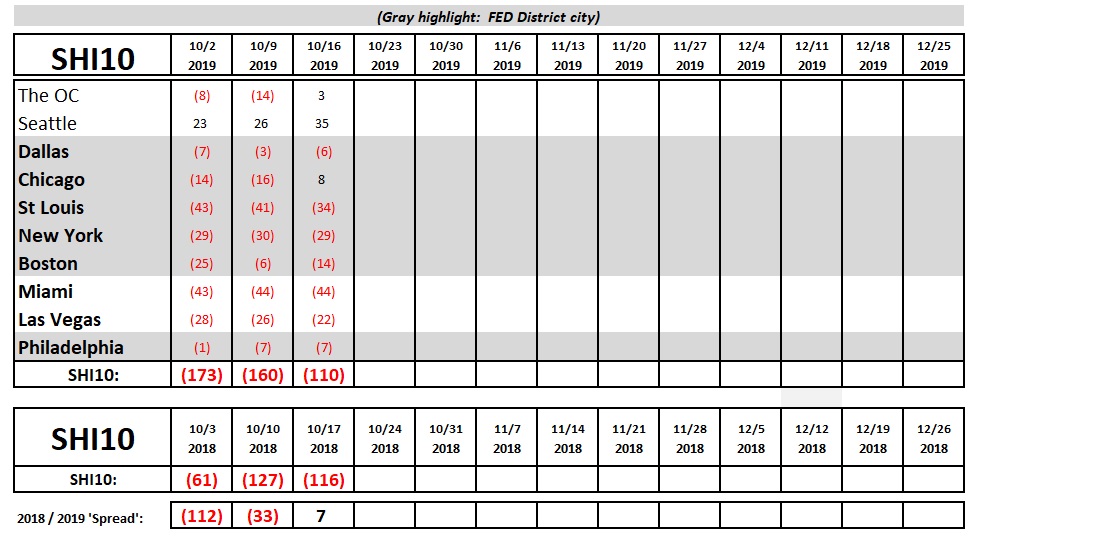

Here’s the longer term trend spreadsheet:

Look at that: Reservation demand this week in 2019 is actually stronger than this same week in 2018. That hasn’t happened for a while. It’s too early to tell if this metric is meaningful, so we’ll keep an eye on this trend.

Yesterday, the International Monetary Fund (IMF) posted their updated global economic forecast. The bottom line: They are worried.

They downgraded global GDP growth forecast to 3.0%. In the aggregate, global GDP growth in the 189 countries tracked by the IMF was 3.8% in 2017. On page 147 of the report, the IMF states that the “value of World Output (billions of US dollars)” was just a hair under $85 trillion. Annual global GDP growth has cooled by 0.8% of $85 trillion, or about $68 billion per year. Ouch. From the executive summary:

“After slowing sharply in the last three quarters of 2018, the pace of global economic activity remains weak. Momentum in manufacturing activity, in particular, has weakened substantially, to levels not seen since the global financial crisis. Rising trade and geopolitical tensions have increased uncertainty about the future of the global trading system and international cooperation more generally, taking a toll on business confidence, investment decisions, and global trade. A notable shift toward increased monetary policy accommodation—through both action and communication—has cushioned the impact of these tensions on financial market sentiment and activity, while a generally resilient service sector has supported employment growth. That said, the outlook remains precarious.”

Precarious. Double-ouch.

Remember, the IMF is a global body. Their view encompasses 189 countries in total. Here in the US they are predicting a “gradual decline in US growth.” I agree. While we’re impacted by the same systemic challenges, a ‘gradual decline’ seems to be the trend here. My concern remains that with the gradual decline our GDP growth factor will eventually slip into the red. Unlike a medium-rare Filet Mignon, where a “warm-red center” is a plus, GDP growth in the red is not a good thing.

– Terry Liebman