SHI 1.9.19 – Just Kidding?

SHI 1.2.19 – Happy Gnu Year!

January 2, 2019

SHI 1.16.19 – Sputtering Engines

January 16, 2019“False alarm … or start worrying? Are the financial markets screaming a recession is around the corner? Or not?”

On September 20, the S&P 500 closed at 2,931. One day before Christmas, December 24, it had slipped down to 2,351. A 20% decline. Ouch. That hurt.

Yesterday, the S&P 500 closed at 2,550 — a 200 point increase, or 9%. We can get whiplash watching this stuff. So are the financial markets trying to tell us something? Or is all this volatility meaningless?

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will continue to be true for years to come.

Is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.66 trillion. In Q3 of 2018, nominal GDP grew by 4.9%. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

Not only did the Dow, S&P 500, and every other major index take a dive, but so did the 10-year Treasury yield. On November 9th, it peaked at 3.21%. Today, it is closer to 2.7% — a 50 basis point decline.

So what are the markets telling us? Is a recession imminent … or is the economy just fine?

The markets are suggesting neither, frankly. The message is this: Our long-lasting economic expansion continues. But we are facing headwinds. FED policy, the Chinese imbroglio, the ‘Wall’ and US government shutdown, slowing corporate profits, etc, all add weight onto the back of the recovery. But the expansion soldiers on.

But pay attention, however, because this is a shot across the bow. Absent dovish comments from FED Chairman Powell, the markets would likely still be in turmoil. But not only has Powell walked back his rigid stance on future interest rate increases and the rate at which the FED is reducing the size of the FED balance sheet, but the just-released December 18-19 minutes of the Federal Open Market Committee (FOMC) meeting say something similar:

“With regard to the outlook for monetary policy beyond this meeting, participants generally judged that some further gradual increases in the target range for the federal funds rate would most likely be consistent with a sustained economic expansion, strong labor market conditions, and inflation near 2 percent over the medium term. With an increase in the target range at this meeting, the federal funds rate would be at or close to the lower end of the range of estimates of the longer-run neutral interest rate, and participants expressed that recent developments, including the volatility in financial markets and the increased concerns about global growth, made the appropriate extent and timing of future policy firming less clear than earlier. Against this backdrop, many participants expressed the view that, especially in an environment of muted inflation pressures, the Committee could afford to be patient about further policy firming. A number of participants noted that, before making further changes to the stance of policy, it was important for the Committee to assess factors such as how the risks that had become more pronounced in recent months might unfold and to what extent they would affect economic activity, and the effects of past actions to remove policy accommodation, which were likely still working their way through the economy.”

Well, that’s dense. Let me interpret: At this time, the FED can take it slow. Future rate increases may — or may not — be needed, depending on data, such as the inflation rate. Which has been falling of late.

The 50 basis point drop in the 10-year Treasury, meaning the value of 10-year Treasury securities went up significantly, is another indicator that inflation is benign at present. AND … a signal that the dreaded inverted yield curve may be approaching sooner than later.

But if you want something to worry about, here you go: Historically, this late in an economic cycle, inflation does tend to heat up…and then decline as the price of goods and services are pressured by excess supply and reduced demand. What’s odd about current events is the absence of economic indicators and data we typically see late-cycle.

So, does that mean we’re well past the peak of this expansion? … or that this cycle has lots of room to run before we see an inflation spike and irrational exuberance? I’m sure every economist you ask will give you a different opinion.

What is my opinion, you ask? For months now, I have been worried the FED was working hard to kill this expansion. But now, if they pause their rate-hike mandate, or at least significantly slow down the rate of hikes, we may have some more running room ahead of us. Thus, we too, like the FED, are data-dependent.

Let’s see what data the steak houses offer us this week.

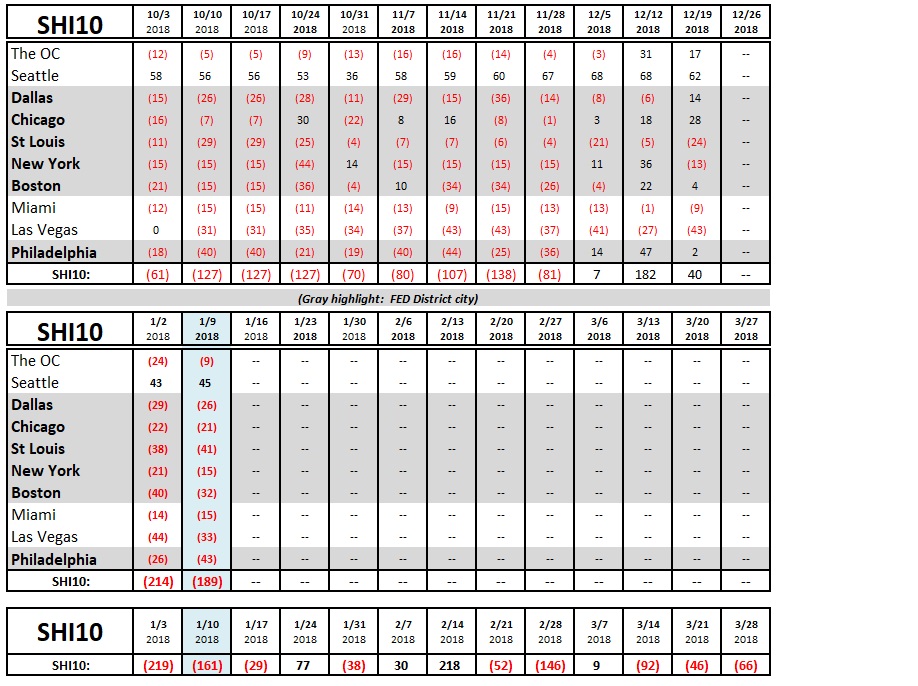

More of the same, is the simple answer. Take a look at the SHI10 long-term trend chart below. I’ve added a feature: At the bottom of the chart, you’ll find the SHI10 results from Q1 of last year — just below the Q1 results for 2019 — for easier comparison:

Interestingly, the readings in 2019 — for the first 2 weeks anyway — are very, very close to the 2018 readings. Restaurant reservation demand in our high-priced eateries seems to be consistent year-over-year.

So the SHI is suggesting — again, at least so far — that public perception and consumer spending are relatively unchanged from 2018. Yes: Whatever fear and anxiety the financial markets are showing seem to be absent with consumers at large. At least, when it comes to ordering $50 ribeyes at Mastros.

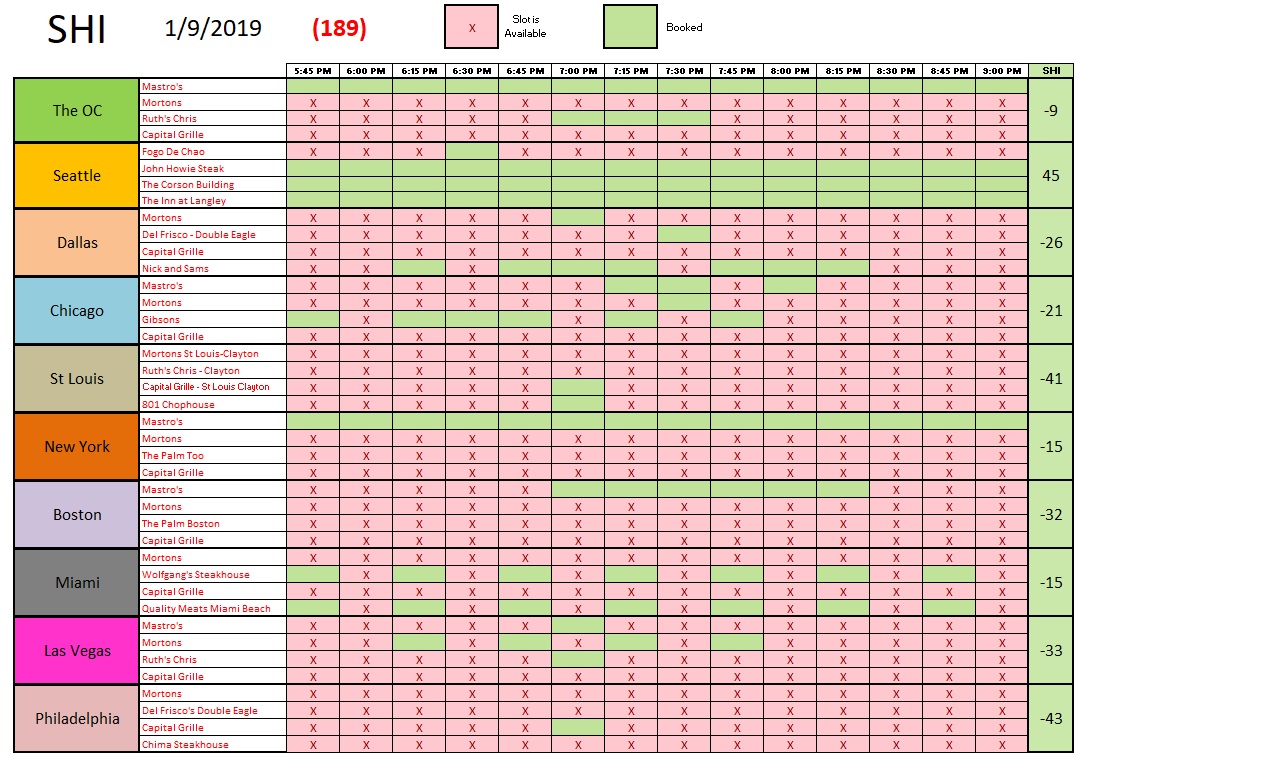

Here’s the weekly chart:

“May you live in interesting times,” the ancient Chinese curse tells us. Indeed.

– Terry Liebman