SHI 1.2.19 – Happy Gnu Year!

SHI 12.19.18 – Spend Like There’s No Tomorrow

December 19, 2018

SHI 1.9.19 – Just Kidding?

January 10, 2019“Yes, that’s a gnu.”

So what does a gnu have to do with economics, you ask?

Not a darn thing. I just happen to like gnus. And gnu is a great scrabble word.

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will continue to be true for years to come.

Is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.66 trillion. In Q3 of 2018, nominal GDP grew by 4.9%. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

The gnu, however, does loom large in my wish that you have a very Happy New Year. One filled with joy, success, family and friends.

2019 is here. Regardless of economic outcome, it promises to be a turbulent and exciting year. Did you know 2019 is the Chinese Year of the Pig? China has certainly been hogging the headlines lately. The Trump administration clearly has a beef with China.

Unfair trade practices is the focal point … and the talk-track issues seem to be the US trade deficit, cross-border tariffs, and intellectual property theft.

But you already knew that.

What you may not know, of may have forgotten, is the US experienced a similar economic challenge from Japan back in the 1970s. For a variety of reasons, Japan was becoming an economic powerhouse, threatening the US balance-of-trade and our position as the economic leader of the world. US imports from Japan were growing rapidly every year. More Americans were deciding to buy a Honda than a Ford. In 1966, one of the best selling cars of all times — the Toyota Corolla — was introduced. Year after year, Japan was winning American pocketbooks through both price and quality. And by 1980, Japan’s auto production surpassed the production here in the US. I’ll spare you the economic disruptions that came as a result, but suffice it to say that a 50% appreciation in the US dollar between 1980 and 1985 led to the ‘Plaza Accord,’ an economic agreement between Japan, France, Germany and the UK, where the US agreed to devalue the dollar against those currencies in order to make US products cheaper as imports into those countries. Years of ignored and seemingly unimportant trade policies had led to significant trade imbalances. Imbalances which — by the early 1980s — threatened US hegemony. Sound familiar?

Historic economists feel Japan fell from economic prominence when the effects of the US dollar devaluation — and the inevitable Japanese yen appreciation — resulted in a Japanese asset bubble, bubble burst, and deflation pretty much ever since. Japan has been trying to break their deflationary spiral for almost 2 decades now. But that’s another story for another day.

Sorry if this is a bit dense. The graphic below should help. It shows the relative relationship between the US GDP and our trading partners — in motion — from 1960 thru 2017. It’s a fascinating piece. Take a look:

My thanks to Dr. Zimmerman, an ardent Steak House Index reader, for sharing this graphic.

We see the rise of Japan’s economic power in the mid-1970s … and how the assent of their GDP (relative to US GDP) was quite rapid. But then it began to slip in the mid-1990s. As Japan’s GDP growth fades, we see China take their place, as #2 in the world, quickly gain ground on US GDP output. Like Japan before them, China seems to be gunning for #1. But unlike Japan, they might actually get there. In the final analysis, while all 3 nations have a highly effective, highly productive workforce, demographics will likely ultimately determine the winner. With a population around 1.4 billion people, China easily wins that battle.

Perhaps the current US challenge to China is a historical imperative. Like a 30-day aged, thick-cut, bone-in Ribeye, conditions may finally be ripe. Many economists, for many years, have been screaming about the US trade deficit. Finally, someone in Washington DC is listening.

Our challenge, of course, is how to manage our personal financial affairs while the battle lines are drawn between China and the US. If anyone was unclear about what’s at steak here (yes, I could have used the correct word, “stake,” but, after all, this is the SHI), financial market performance in the 4th quarter eliminated any doubt.

Will corporate profits be adversely impacted by a protracted trade war? Most certainly.

Might a trade war be the catalyst that pushes the US into our long-awaited recession? Maybe. But maybe not.

The economic battles with Japan back in the 1980s did not push the US into recession. The FED did. For good reason, however. US GDP growth exceeded 13% in 1981 … sliding all the way down to about 3.2% by the end of 1982 — primarily due to FED interest rate policies and the FEDs attempt to break the back of inflation. Fortunately, the FED won and the extremely high inflation rates were banished. Perhaps forever.

It’s worth noting, however, that global financial and economic skirmishes take a long time to play out. So as our new year begins, settle in for a long one. It’s unlikely the China/US “thing” will be fully resolved any time soon.

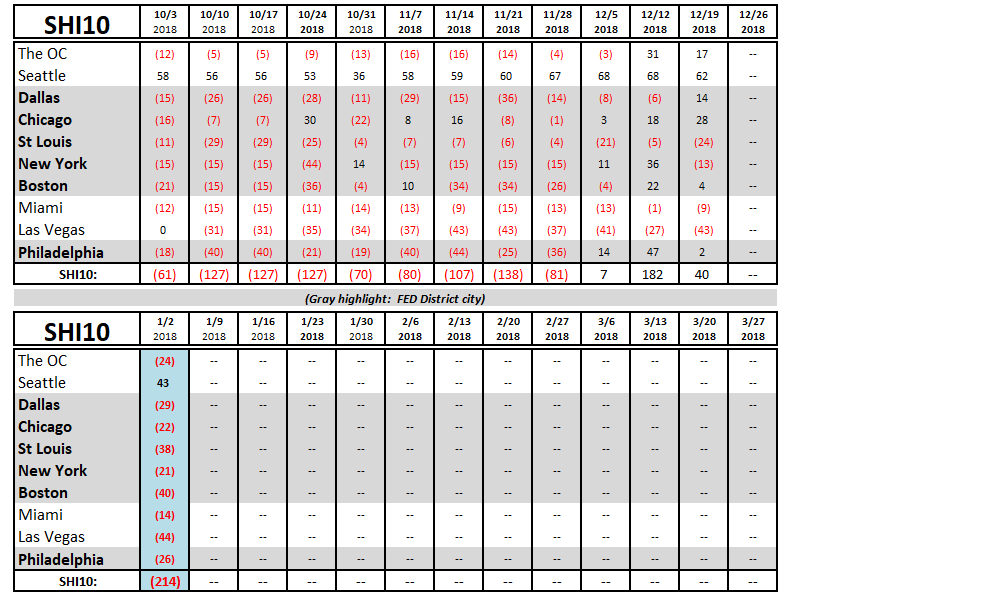

Knowing that, let’s head to the steakhouses. How is our first SHI10 reading comparing to the last 2018 reading … and one from this time last year?

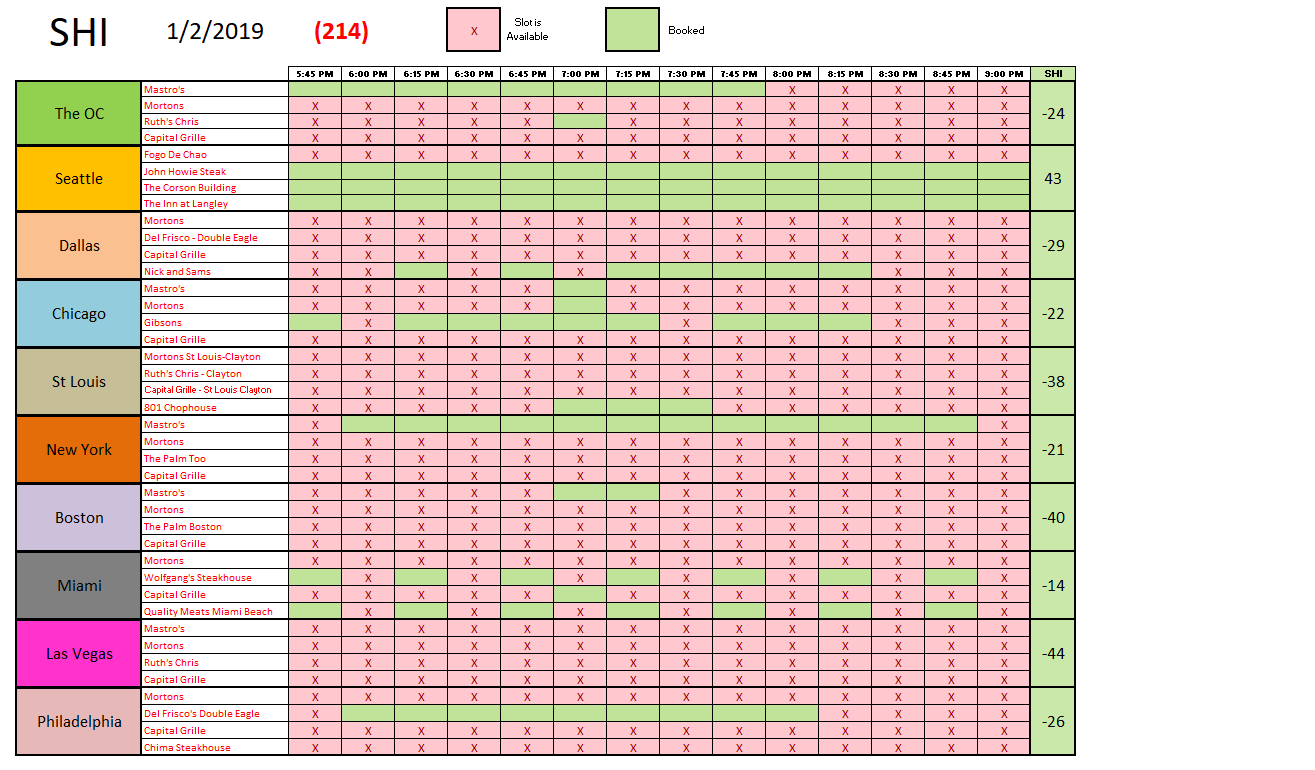

Clearly not so hot, when compared to the Dec 19 SHI10 reading. But that’s not surprising. Our first SHI10 reading, taken on January 3, 2018, was also quite weak: A negative 219. Almost identical. December is apparently a great month to operate an expensive steakhouse. January, clearly, is not. Here is the weekly survey:

We’re seeing a whole lot of red up there. Reservations are plentiful this Saturday, so take your pick!

Permit me a few final comments on the US/China trade-war. While it is likely the clash will (already has, frankly) disrupt business, by itself it is unlikely to push the US into a recession. Like many stock market participants, I believe the growth rate of corporate profits will be adversely impacted. But corporate profits will still grow. Just at a slower rate.

If, on the other hand, as this battle rages the FED decided to raise the funds rate another full percentage point in 2019, that might do the trick. In that case, I feel a 2020 recession would clearly be right around the corner.

Fortunately, the FED seems a bit subdued by the Q4 financial markets … and the fact that no matter where they look, inflation is hard to find. The PCE seems pretty tame in the 1.5% to 2% range. For good reason, the FED remains concerned about potential wage pressures, but they have yet to materialize. And I don’t think they will. At least not to the extent the FED is expecting.

We’ll keep monitoring developments. Thanks for tuning in.

- Terry Liebman