SHI 02.06.19 – The White House and The SHI

SHI Update 1.30.19 – Weighing the Data

January 30, 2019

SHI 02.13.19 – Hungary is Hungry … for Children

February 13, 2019“Imagine this: You are Donald Trump. You have invited FED Chairman Powell to dinner to discuss the U.S. economy. What do you serve?”

CORRECT! Steak!

Monday evening, Jerome Powell and the President ‘broke bread’ at the White House. We’re told it was an “informal dinner” in the White House residence “to discuss recent economic developments and the outlook for growth, employment and inflation.”

Precisely! Nothing goes better with economics than steak! Just sayin’. 🙂

Welcome to this week’s Steak House Index update.

If you are new to my blog, or you need a refresher on the SHI10, or its objective and methodology, I suggest you open and read the original BLOG: https://www.steakhouseindex.com/move-over-big-mac-index-here-comes-the-steak-house-index/

Why You Should Care: The US economy and US dollar are the bedrock of the world’s economy. This has been the case for decades … and will continue to be true for years to come.

Is the US economy expanding or contracting?

According to the IMF (the ‘International Monetary Fund’), the world’s annual GDP is about $80 trillion today. US ‘current dollar’ GDP now exceeds $20.66 trillion. In Q3 of 2018, nominal GDP grew by 4.9%. We remain about 25% of global GDP. Other than China — a distant second at around $12 trillion — the GDP of no other country is close.

The objective of the SHI10 and this blog is simple: To predict US GDP movement ahead of official economic releases — an important objective since BEA (the ‘Bureau of Economic Analysis’) gross domestic product data is outdated the day it’s released. Historically, ‘personal consumption expenditures,’ or PCE, has been the largest component of US GDP growth — typically about 2/3 of all GDP growth. In fact, the majority of all GDP increases (or declines) usually results from (increases or decreases in) consumer spending. Consumer spending is clearly a critical financial metric. In all likelihood, the most important financial metric. The Steak House Index focuses right here … on the “consumer spending” metric. I intend the SHI10 is to be predictive, anticipating where the economy is going – not where it’s been.

Taking action: Keep up with this weekly BLOG update. Not only will we cover the SHI and SHI10, but we’ll explore related items of economic importance.

If the SHI10 index moves appreciably -– either showing massive improvement or significant declines –- indicating growing economic strength or a potential recession, we’ll discuss possible actions at that time.

The BLOG:

“Steakonomics.” It’s a real thing. Powell knows it. Trump knows it. And we know it.

We’ll get to this week’s SHI update shortly. First, let’s take a look at some of the economic data the President and the Chairman probably discussed: Labor productivity.

Growth in the ‘civilian labor force,’ and growth in ‘labor productivity,’ combine to be the long-term “speed limit” for potential U.S. GDP growth. Said another way, inasmuch as our GDP measures the amount of “stuff” America creates (products and services) each year, our country can only make more stuff if:

- We have more people at work, making stuff,

- The folks working to make stuff become more productive, or

- Some combination of the two.

The U.S. civilian labor force is now slightly over 163 million people. In 2018, it grew by about 2.1 million people (a good year!) or 1.31%.

Earlier today, the ‘Bureau of Labor Statistics’ released the preliminary full-year 2018 metrics for ‘Productivity and Costs.’ Here’s the news release, if you’re interested.

https://www.bls.gov/news.release/prod2.nr0.htm

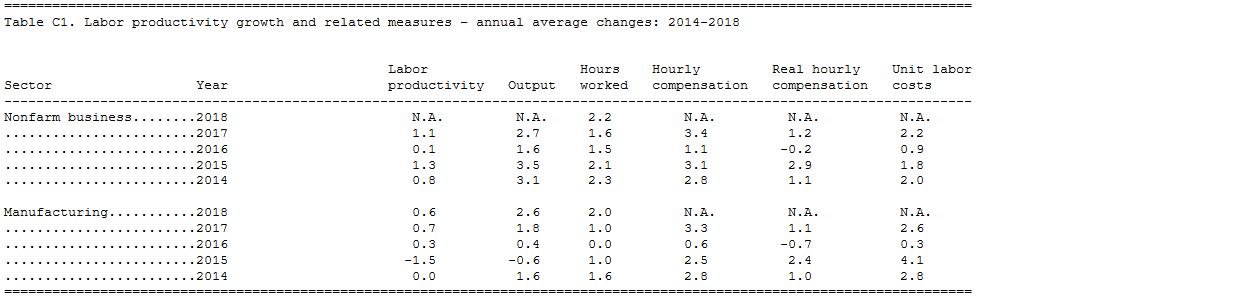

If you don’t want to completely dive in, consider this summary chart:

Manufacturing productivity increased by 0.6% in 2018. As we can see, this is very similar to the 2017 growth rate of 0.7% … both of which are quite a bit higher than the prior 3 years.

These are not great numbers, by the way. Between 1947 and 1973, labor productivity growth averaged 3.25% annually. Between 1973 and 1990 — a generally difficult time with exceptionally high interest rates and turbulent oil prices — productivity slipped to about 1/2 this level. But in 1990 to 2000, it rebounded to an average of 2.3% … and from 2000 to 2007 — just before the Great Recession — productivity averaged 2.7% annually. Clearly, the last 5 years have been sub-optimal.

It is interesting to note total ‘output’ actually grew by 2.6% during 2018 — due to an increase in ‘hours worked’. A very positive sign for 2018. But increases in hours worked do not impact GDP growth over the long term. They vary and fluctuate over the short term — influenced by many factors such as consumer demand — but potential increases in hours worked are inherently finite.

So we’re back to basics. With a 0.6% productivity increase and a 1.31% worker increase, the our U.S. implied annual GDP growth limit is 1.92%. The hours worked component will create an upward, short-term boost. But the longer term ‘speed limit’ remains at around 2% per annum. Unfortunately. I suspect that between bites of juicy, succulent filet mignons, Mr. Powell shared these facts with Mr. Trump.

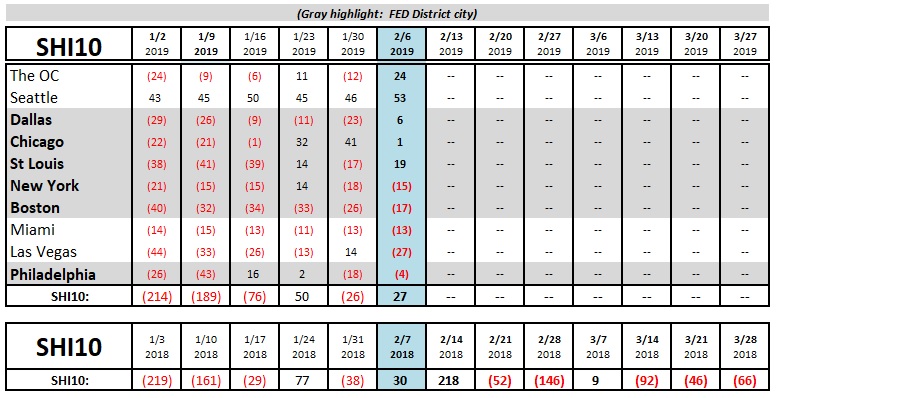

Our steak houses are telling us the U.S. economy continues to hum along … take a look at our trend analysis:

On February 7th — back in 2018 — the SHI10 reading was a positive 30. Our reading this week is 27. Once again, we’re seeing an outcome very similar to last year. Very interesting and very consistent. Next week, of course, is Valentines Day. Have you made your restaurant reservations yet? You’d better hurry. Look at the SHI10 reading last year — 218! Valentines Day apparently generates the strongest restaurant reservation demand of the year. It will be interesting to see we get the same result next week. I suspect we will.

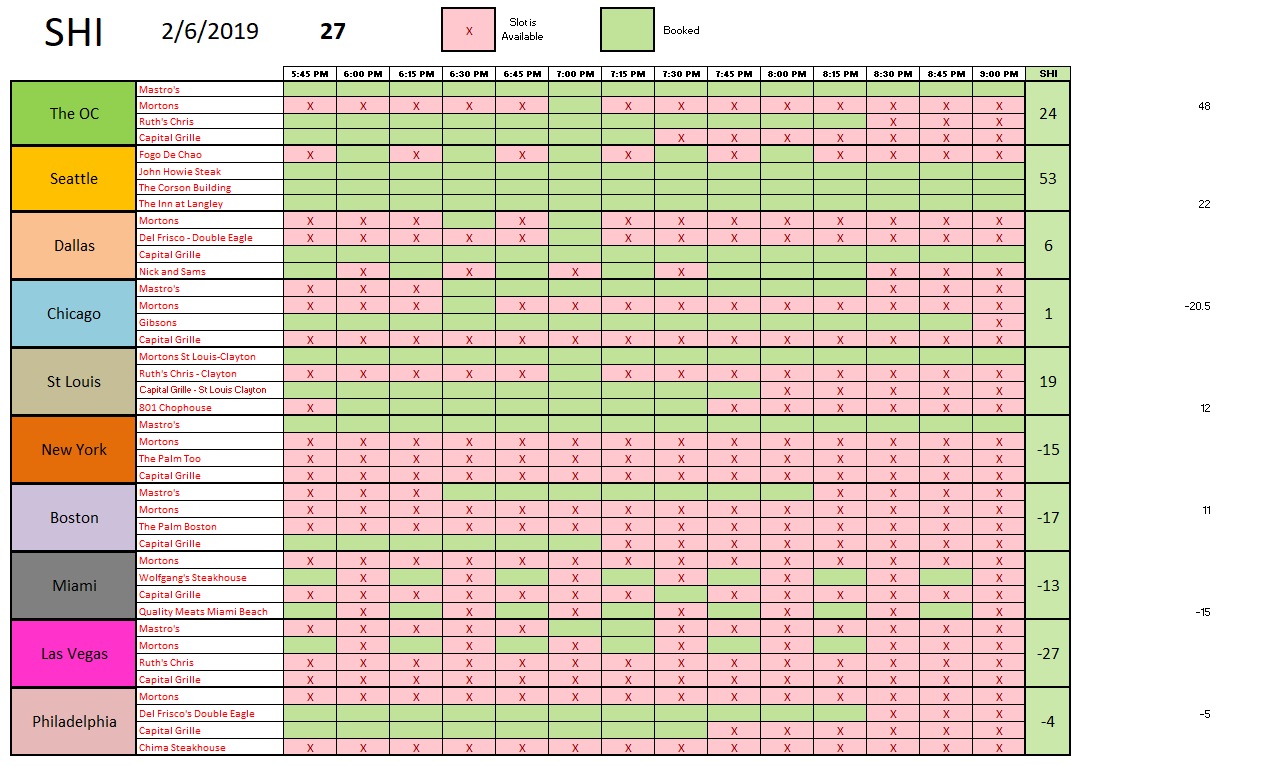

Here is the weekly chart:

I see a lot of green. Meaning those time-slots are fully booked. Expensive steaks are in vogue this Saturday.

Yet again, cows are working hard to get the message out:

“EAT MOR CHIKIN”

But this Saturday and the next, I suspect they will have little success. 🙂

- Terry Liebman